Bangalore just added 16,000+ startups in 2024 alone, many of them emerging from the best tech parks in Bangalore that fuel innovation at scale.

Think about that for a second.

That’s not just noise. That’s an ecosystem on steroids.

But here’s the hard truth: most of those startups won’t make it, even with access to capital from top VC firms in Bangalore. Because at the end of the day, the market doesn’t care about your idea, your funding, or your pitch deck, it only cares about whether you’re solving a real problem and creating real impact.

What matters?

Execution. Real growth. Actual traction.

This blog isn’t another copy-paste list of “startups to watch.” We’ve dug deep into the Bangalore ecosystem and identified the 9 startups that are actually taking India’s startup scene by storm. These are the companies raising serious capital, solving real problems, and reshaping how India does business.

By the end of this article, you’ll know:

→ The startups that are genuinely worth your attention

→ What makes each one different (not just “they got funding”)

→ Growth strategies you can steal for your own business

→ How these founders are building brands, not just products

→ Why 2026 is the year these companies go global

But here’s the real reason to read this:

If you’re a founder, investor, or someone building in the startup ecosystem, you need to understand the playbook these winners are using. Most startups miss it. They build great products but fail at growth marketing, positioning, and scaling.

At ZeroAdo, among the top Bangalore SEO agencies, we’ve studied these founders’ growth playbooks, and we’ve helped startups at every stage execute similar strategies.

So this blog isn’t just a list.

It’s a growth manual.

Let’s dig in.

- The Bangalore startup ecosystem: Why it matters in 2026

- Top 9 startup companies in Bangalore that’ll change the way you think about growth

- Startup #1: Rapido – The mobility unicorn that just hit $2.3 Billion

- Startup #2: Ai.tech – The fastest bootstrapped unicorn in India’s AI boom

- Startup #3: Zepto – Quick commerce’s dominant player

- Startup #4: Darwinbox – HR tech’s #1 platform

- Startup #5: Jumbotail – The B2B kirana revolution

- Startup #6: Navi Technologies – Fintech’s profitability story

- Startup #7: Ather Energy – The EV mopeds & infrastructure play

- Startup #8: LeadSquared – The high-velocity SaaS unicorn that’s crushing sales automation

- Startup #9: Sprinto – Compliance tech for SaaS

- Comparative analysis: What these 9 startups have in common

- Pattern #1: Data-driven decision-making

- Pattern #2: Early investment in brand and thought leadership

- Pattern #3: Strategic partnerships with specialists

- Pattern #4: Founder-led content and community building

- Pattern #5: SEO-first growth (for SaaS and B2B)

- Pattern #6: Cross-border expansion mindset

- The common thread

- Growth strategies these startups used to scale

- Lessons for other Bangalore startups: The blueprint

- Lesson 1: Start with brand positioning, not just product

- Lesson 2: SEO and content marketing compound, so invest early

- Lesson 3: Founder visibility & thought leadership accelerate fundraising

- Lesson 4: Strategic partnerships multiply growth

- Lesson 5: Data-driven CAC optimization separates fast-growing startups from the rest

- Lesson 6: Build community, not just customers

- The road ahead: What’s next for Bangalore startups

- How will you join the next wave of Bangalore startups?

- Handpicked Articles for You

- Frequently asked questions about startup companies in Bangalore

The Bangalore startup ecosystem: Why it matters in 2026

Bangalore isn’t just a startup hub, it’s one of the most vibrant ecosystems for growth, from technology to commerce and business hubs in Bangalore.

It’s the startup hub.

Right now, the city isn’t just leading India, it’s defining how the world builds from India. And 2026 feels like the inflection point where that dominance truly goes global.

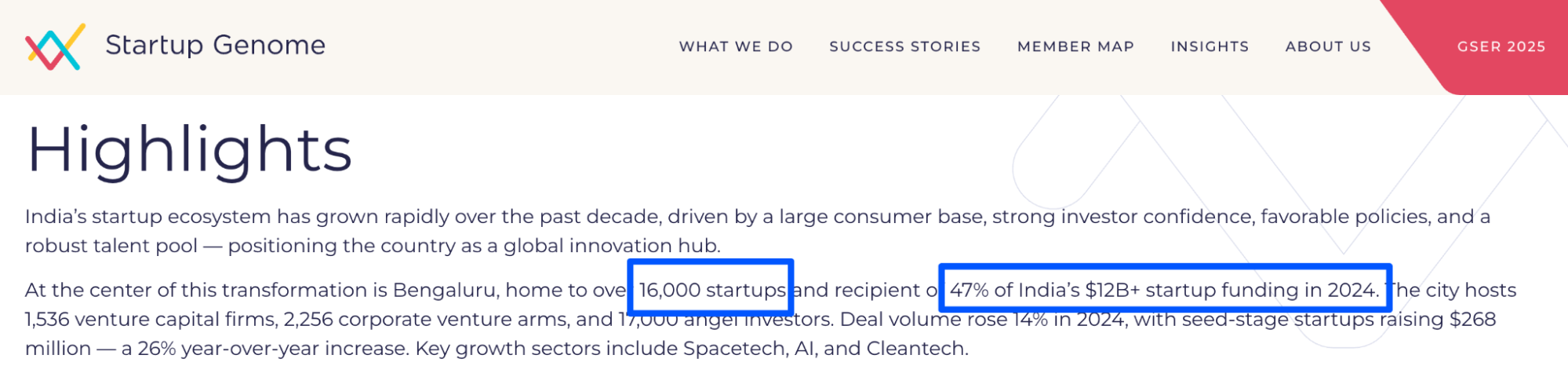

The numbers tell the story:

- #14 globally in the Startup Genome Index

- #5 worldwide in AI & Big Data ecosystems

- Home to 26 unicorns worth $70 billion

- 41 soonicorns valued at $16 billion

- 16,000+ startups, 1 million+ tech professionals, and nearly half of India’s $12 billion startup funding flowing right here into Bangalore

That’s not hype. That’s data.

Nearly 47% of India’s startup capital is concentrated in this one city.

That’s not just scale, it’s momentum with muscle.

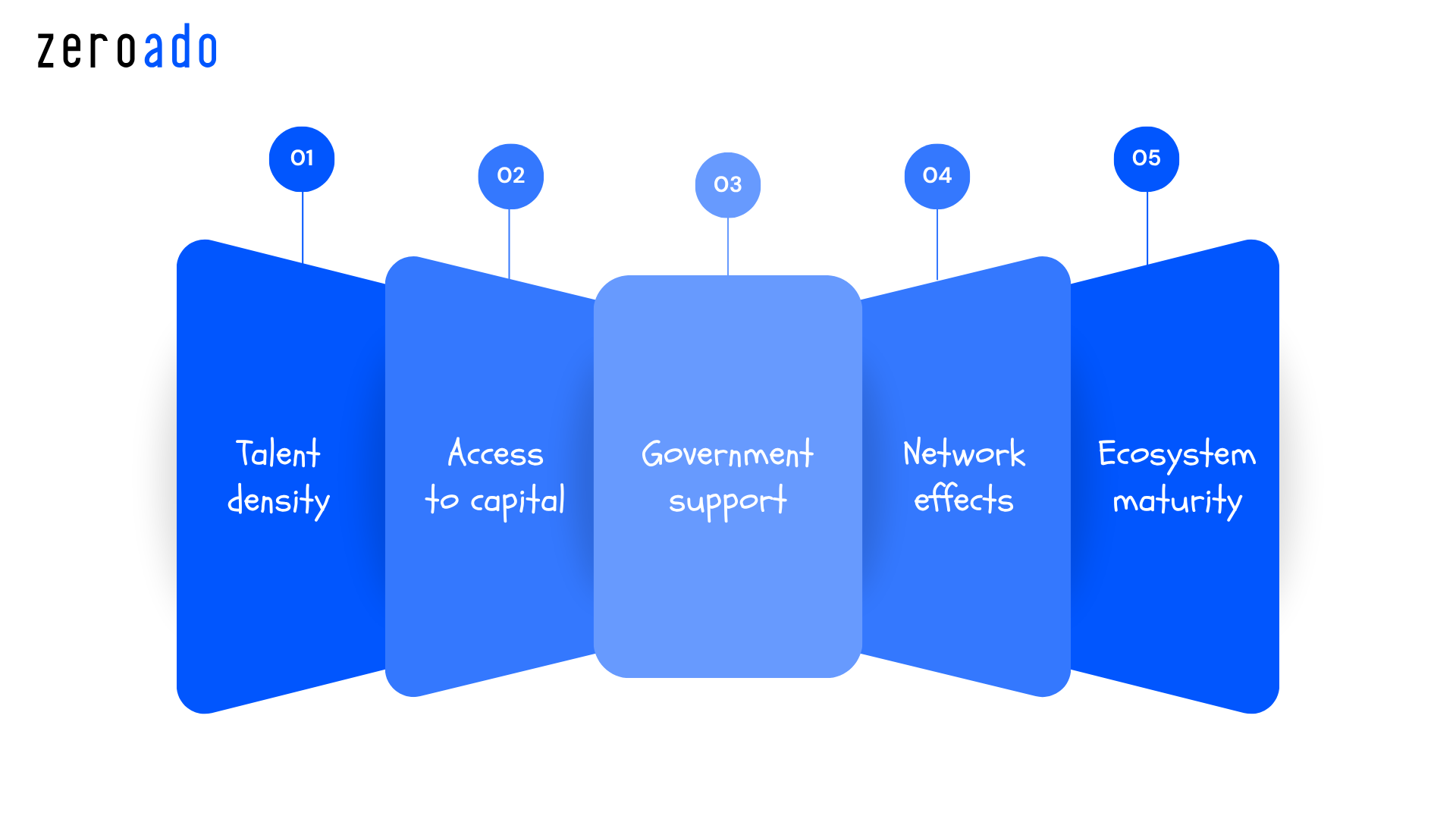

So why is Bangalore winning?

Talent density

Every ambitious engineer, product manager, and growth marketer eventually lands here. The city’s talent pool is the densest in India.

Access to capital

VCs live here. From early angels in Indiranagar cafés to VCs on MG Road, funding circulates fast. Investors don’t just write cheques, they mentor, network, and help scale.

Government support

Initiatives like ELEVATE 2024, tax benefits, and infrastructure upgrades have made Karnataka one of India’s most startup-friendly states.

Network effects

Success breeds success. Every founder knows someone who exited, raised money, or built something big. You learn from winners.

Ecosystem maturity

Unlike 5 years ago, Bangalore’s startup infrastructure is now built out. Co-working spaces, SaaS accelerators, legal firms, HR consultants, marketing agencies and everything else a growing business needs is here.

But the real story for 2026?

The sector mix is changing. It’s no longer just SaaS and fintech.

AI/ML is booming. Healthtech is solving deep Indian problems. Deeptech is attracting global attention. Compliance tech is becoming essential infrastructure.

This diversification means the startup ecosystem isn’t betting on one trend anymore. Multiple bets are winning simultaneously.

That’s the Bangalore story in 2026.

Now let’s meet the 9 startups leading this charge.

Top 9 startup companies in Bangalore that’ll change the way you think about growth

Startup #1: Rapido – The mobility unicorn that just hit $2.3 Billion

Tagline & mission

“Making mobility simple, affordable, and instant.”

The core mission? Give Indians a faster way to move around cities without paying premium Uber prices.

The problem they solved

Back in 2015, Bangalore’s biggest pain point wasn’t funding or food, it was traffic.

Cabs took 20 minutes to arrive. Autos were unpredictable. And then there were bikes, the fastest way to move through city traffic, but no organized way to hire one.

Rapido saw the gap.

That’s when Rapido asked one simple question:

“Why isn’t bike-hailing as organized as cab-hailing?”

That single insight built a billion-dollar business (a unicorn).

Unique value proposition & business model

Rapido isn’t trying to beat Ola or Uber at their game.

They built their own lane, literally.

They owned two-wheelers, India’s most common and efficient form of transport. Bikes are faster, cheaper, and everywhere, Rapido just organized that chaos.

The business model is simple: Take a commission on each ride.

But they’re smart about it. They’re not just a ride-hailing app—they’re building a multi-service platform.

Food delivery (Ownly), logistics (Rapido Parcel), and more.

That’s ecosystem thinking.

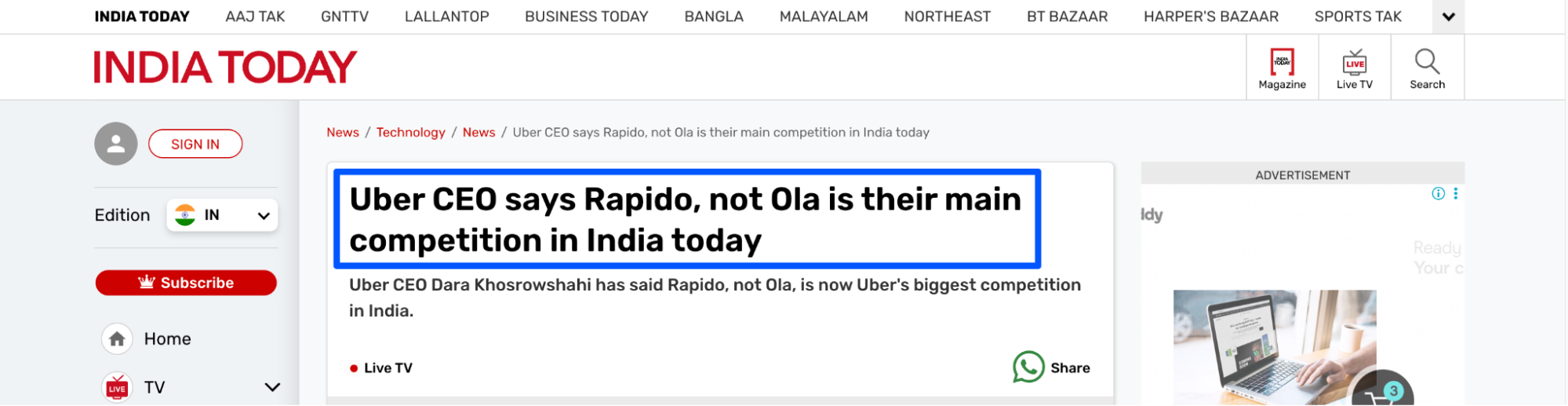

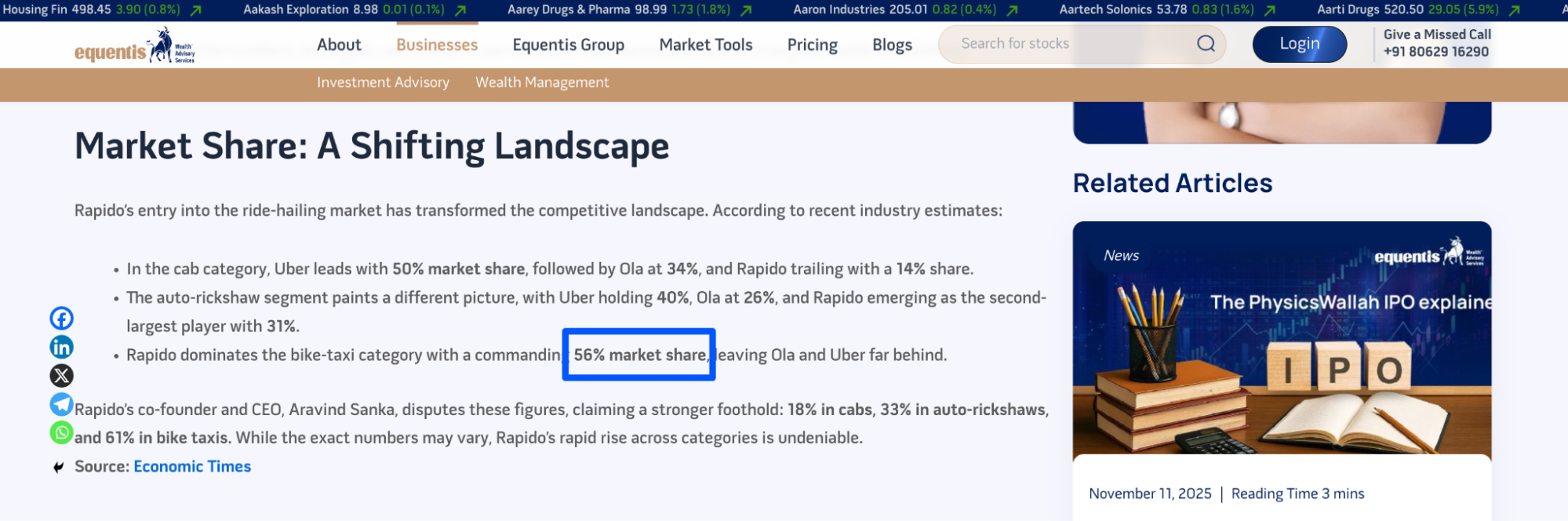

Growth metrics

- Funding: $500–550 million (latest round)

- Valuation: $2.3 billion (unicorn club)

- Market share: 50% of India’s two-wheeler market

- Monthly active users: 50 million+ (more than Uber India)

- Annual revenue: ₹1,000+ crore

- YoY growth: 40%

- Operating revenue: ₹648 crore (up 46% YoY)

- Loss reduction: 45%

Even Uber’s CEO publicly acknowledged that Rapido, not Ola, is their real competitor in India.

Recent milestones

→ Crossed 50M MAUs

→ Expanded into four-wheelers

→ Launched Ownly (food delivery)

→ Secured $240–250M from Prosus

→ Cut losses by 45% while growing

Why they’re worth watching in 2026

Two reasons:

1. They didn’t fight incumbents and found a wedge

Instead of battling Ola and Uber in cabs, Rapido owned the bike niche and now controls 50% of that market. Then it expands to adjacent categories.

2. They’re proving profitable growth is possible

The “growth-at-any-cost” era is ending. Rapido’s showing that you can grow 40% YoY and improve margins.

Swiggy exited their stake in Rapido. Why? Because they realized the conflict. Now Prosus is doubling down signals strong institutional confidence.

Growth lesson for founders

Most founders see a crowded market (Ola, Uber) and think “it’s saturated.” Rapido saw the same market and thought “there’s a wedge nobody’s attacking.”

That wedge thinking is what separates winners from also-rans.

Also, they didn’t chase revenue at the cost of unit economics. They built sustainable growth. That’s harder but it’s real.

The takeaway? Own one specific segment first. Dominate it. Then expand. Don’t try to do everything at once.

Startup #2: Ai.tech – The fastest bootstrapped unicorn in India’s AI boom

Tagline & mission

“Building full-stack AI solutions without venture capital.”

While most AI startups chase big funding rounds, Ai.tech took the opposite route.

They raised zero external capital, and still hit a $1.5 billion valuation.

That’s not just rare, it’s revolutionary.

The problem they solved

How many times have you heard this: “Is AI useful?”

Of course it is. Everyone knows that.

The real question has always been, “How do we actually use it at scale?”

Every company wanted to adopt AI. But very few knew how to deploy it in production and make it work in the real world.

While most were selling AI hype, Ai.tech decided to build working AI.

They focused on real enterprise problems—from automating risk detection in fintech to optimizing supply chains for manufacturers, and delivered results.

Unique value proposition & business model

Ai.tech is a full-stack AI studio. They don’t sell software off-the-shelf.

They build custom AI solutions from the ground up.

Large enterprises have complex, unique problems. Off-the-shelf AI tools don’t cut it. You need custom solutions. Ai.tech builds those.

The business model?

Project-based revenue + retainers. You pay for the solution they build for you. Repeatable. Profitable.

That’s why they never needed VC money.

Growth metrics

- Funding: 100% bootstrapped

- Valuation: $1.5 billion (unicorn status in under 3 years)

- Founded: 2022

- Team size: 300+ AI engineers

- Profitability: Positive unit economics from day one

- Clients: Fortune 500 enterprises across BFSI, retail, and manufacturing

While most AI startups burned $50M+ before finding traction, Ai.tech hit profitability in year one.

Recent milestones

→ Joined India’s unicorn club (2026)

→ Expanded to 300+ AI engineers

→ Built proprietary AI models

→ Attracted enterprise clients (Fortune 500 companies)

→ Now raising capital on their own terms

Why they’re worth watching in 2026

We both know that AI is the hottest sector. Every VC is throwing money at AI companies. But most of those companies are building hype, not real businesses.

While the world’s chasing the next ChatGPT clone, Ai.tech quietly built a profitable AI services engine, one that actually ships value.

Their next move is to turn their proprietary AI frameworks into a developer platform, expanding beyond India into Southeast Asia and the Middle East.

If that happens, they’ll be India’s first bootstrapped AI platform unicorn.

Growth lesson for founders

Here’s the contrarian truth:

Revenue beats funding. Profitability beats hype.

Ai.tech didn’t raise because they didn’t need to.

They stayed lean, disciplined, and obsessed with real customer value.

Most founders do it backward. They raise money first, then try to figure out profitability. By then, they’re addicted to capital.

Ai.tech flipped that playbook and built leverage instead.

Their positioning line says it best:

“We’re not a hype play. We’re a business.”

Startup #3: Zepto – Quick commerce’s dominant player

Tagline & mission

“10-minute grocery delivery. Actually 10 minutes.”

Zepto didn’t invent the category. But they’re winning it.

The problem they solved

People don’t want to wait.

Especially for groceries.

You run out of milk at 11 PM. You need it now, not tomorrow.

Before Zepto, you were stuck. Blinkit existed but often missed the “quick” in quick commerce.

Then Zepto came in and said, “We’ll deliver in 10 minutes. Guaranteed.”

That’s a promise. Not hype.

Unique value proposition & business model

Zepto operates dark stores (mini warehouses) in high-density areas.

Popular items are pre-stocked. When an order drops, it takes 3–4 minutes to pick and 6–7 minutes to deliver.

That’s the entire model in one equation:

Inventory positioning + logistics optimization = 10-minute delivery.

Their business model combines:

- Commission on orders

- High order frequency (5–6x per week)

- Premium pricing

People pay more for speed. Zepto captures that premium.

Growth metrics

- Funding: $450M latest round (total $900M+)

- Valuation: $5B+ (among India’s most-funded startups)

- Dark stores: 100+ across major cities

- Cities: Bangalore, Mumbai, Delhi, Chennai, Hyderabad, and more

- Delivery time: 10 minutes (often 8–9)

- Repeat rate: 60%+

- Market share: Leading quick commerce player alongside Blinkit

The quick commerce market is projected to hit $5.5B by 2025, and Zepto is currently setting the pace.

Recent milestones

→ Crossed 100 dark stores nationwide

→ Expanded to six major metros

→ Raised $450M (Sept 2026)

→ Hit 60% repeat customer rate

→ Achieved profitability in select markets

Why they’re worth watching in 2026

Quick commerce isn’t a trend, it’s the next wave of retail.

But unit economics are brutal. You’re paying for fast delivery, inventory management, and operational overhead. One wrong move and you bleed money.

Zepto is one of the few quick commerce players actually managing unit economics well. They’re disciplined about expansion: they enter a city, build density, then expand.

Also, Reliance Retail just entered quick commerce. That’s a threat. But Zepto’s four-year head start and brand loyalty give it a serious moat.

Growth lesson for founders

Speed matters. But sustainability matters more.

Zepto didn’t race to expand in 50 cities. They built deep density in fewer cities first. That’s how you build a defensible business.

Also, they’re not just a logistics company. They’re a retail company using logistics as their moat.

Their positioning says it best:

“We didn’t invent 10-minute delivery. We perfected it.”

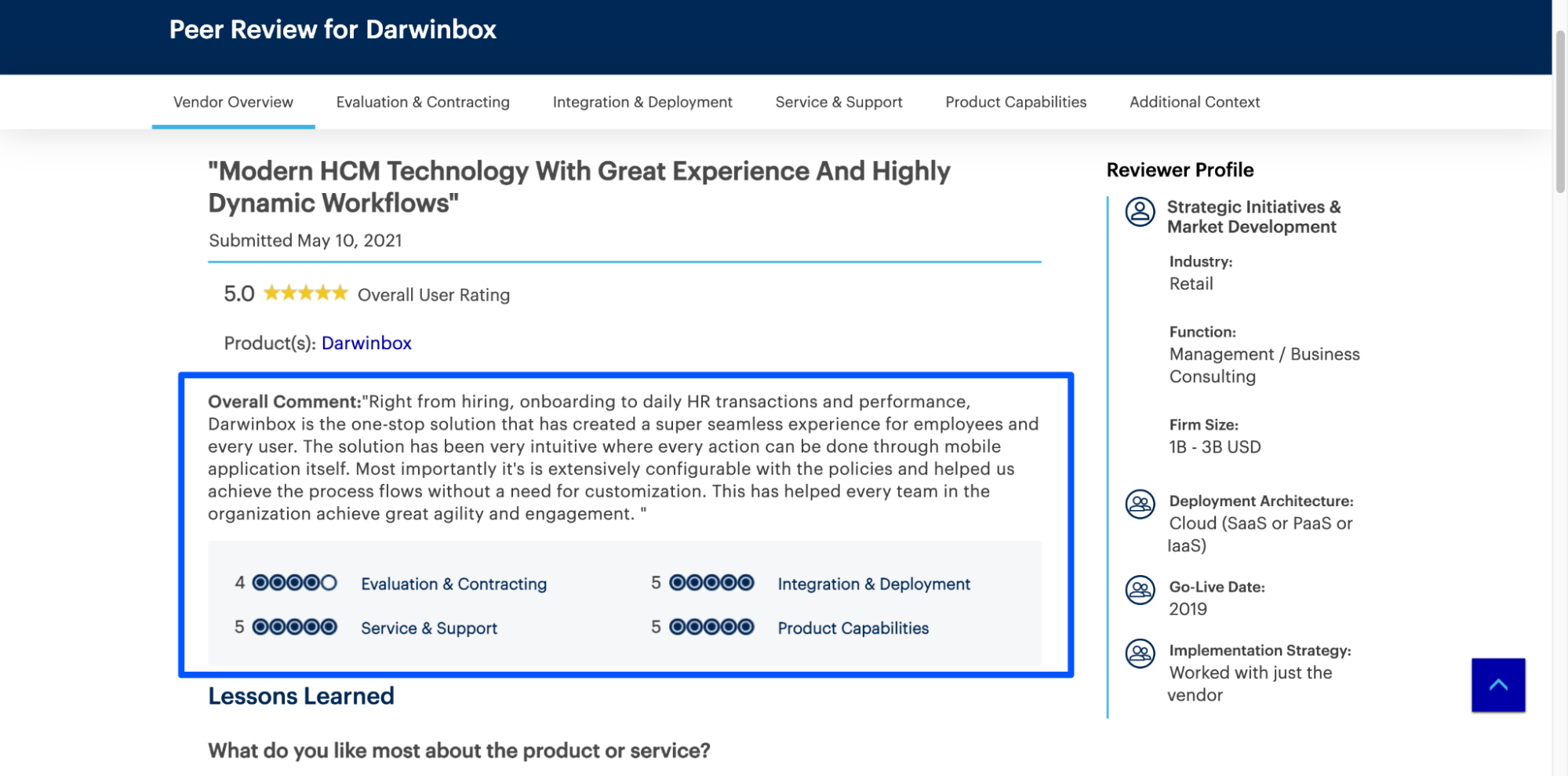

Startup #4: Darwinbox – HR tech’s #1 platform

Tagline & mission

“Modern HR that actually works.”

Darwinbox has been quietly winning for nearly a decade. Now they’re the category leader.

The problem they solved

HR software used to suck.

It was old, clunky, and built for a world that no longer exists.

Global giants like SAP SuccessFactors and Oracle owned the enterprise space, but they were slow, expensive, and painful to use.

Darwinbox asked a simple question:

“What if we built HR software for the modern era?”

Their answer: cloud-first, mobile-first, and employee-friendly HR that actually gets used.

Unique value proposition & business model

Darwinbox built an HR Suite (HCM) that covers recruitment, onboarding, payroll, performance management, and employee engagement.

But here’s what sets them apart: people actually enjoy using it. Both HR teams and employees love the experience.

Their business model is SaaS subscription based. Per-employee-per-month pricing that scales as customers grow.

And today we all know that this is the most predictable revenue model in software industry.

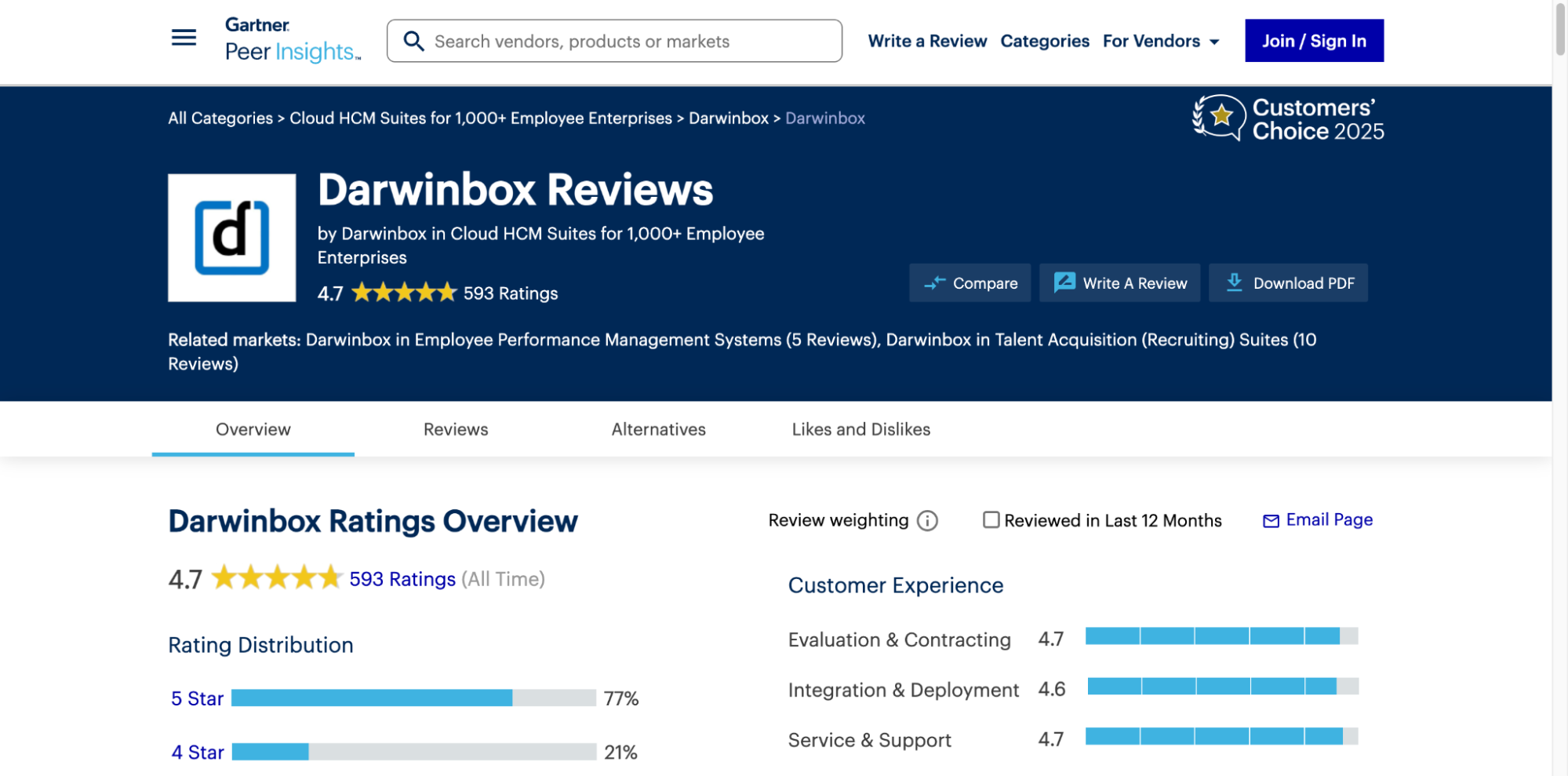

Growth metrics

- Funding: $140M (Series D, Jan 2023)

- Valuation: $1B+ (unicorn status)

- Customers: 850+ global organizations

- Employees managed: 2.2M across 116 countries

- Client roster: Adani, Starbucks, Apollo, JSW, Swiggy, Tokopedia

- Gartner recognition: Featured 3 years in a row on the Magic Quadrant

- Customer rating: 4.7/5 on Gartner Peer Insights

A 4.7 rating is almost unheard of in enterprise SaaS, and that’s not adoption dude, that’s love.

Recent milestones

→ Ranked #1 on Gartner Peer Insights for HCM

→ Expanded globally (116 countries)

→ Launched PROSE (proprietary HR-specific AI model trained on 100K+ datasets)

→ Backed by KKR and Partners Group (major institutional capital)

→ Launched aggressive US market expansion

Why they’re worth watching in 2026

HR tech is becoming critical infrastructure. Every company needs modern HR software.

Darwinbox understood early that AI in HR isn’t a trend, it’s a necessity. Their proprietary AI engine, PROSE, gives them a major competitive edge.

In 2026, expect them to dominate the global HR tech space. US expansion is huge because that’s where the money is.

Growth lesson for founders

Darwinbox didn’t try to challenge SAP or Oracle on day one.

They mastered India first: refined their product, built credibility, and only then went international with institutional backing.

It’s a masterclass in sequencing.

Their positioning sums it up perfectly:

“Built for modern work. Loved by users.”

Startup #5: Jumbotail – The B2B kirana revolution

Tagline & mission

“Empowering mom-and-pop stores to compete with supermarkets.”

Jumbotail is India’s largest B2B grocery platform for small retailers. And they just crossed the unicorn threshold in 2026.

The problem they solved

Kirana stores are the backbone of Indian retail.

Every neighborhood has 3-4 of them. People love them. But they’re getting crushed by Reliance Retail, Dmart, Blinkit, and the quick commerce wave.

The issue? Kiranas can’t scale.

They buy from multiple suppliers, manage inconsistent pricing, and stock inventory based on gut instinct, not data.

Jumbotail saw the gap and asked:

“What if kiranas had the same infrastructure as large retailers?”

That question turned into a billion-dollar business.

Unique value proposition & business model

Jumbotail is a one-stop platform for kiranas.

Instead of calling 10 suppliers, they just order on Jumbotail.

They get next-day delivery, bulk discounts, and working capital.

But Jumbotail didn’t stop there. They help stores modernize layouts, install digital POS systems, and even offer financial products.

Their business model combines:

- Commissions on every order

- Fintech products like credit access and insurance

- Data monetization through supply insights

Growth metrics

- Funding: $120M Series D (April 2025)

- Total raised: $263M

- Valuation: $1B (unicorn status)

- Kiranas onboarded: 50,000+ new stores in Q3 2024

- Market reach: 15% of India’s B2B grocery market

- Annual revenue: ₹2,500+ crore

- YoY growth: 85%

50,000 new stores onboarded in 3 months. That’s the adoption velocity most SaaS companies dream about.

Recent milestones

→ Achieved unicorn status (April 2026)

→ Acquired Solv to expand fintech capabilities

→ Expanded operations to 15+ states

→ Mapped a profitability roadmap

→ Backed by SC Ventures (institutional validation)

Why they’re worth watching in 2026

Quick commerce might grab headlines, but kiranas still dominate the Indian retail landscape.

Jumbotail’s bet is clear:

Empower kiranas with tech, logistics, and finance so they can compete instead of disappear.

And the numbers prove it’s working: 50,000 stores onboarded in just three months. That’s scale and stickiness.

What makes this story powerful is that Jumbotail isn’t chasing trends, they’re solving a hard supply chain problem that few can replicate.

Growth lesson for founders

Market size isn’t everything. Market addressability is.

Udaan targets wholesalers. Jumbotail targets kiranas specifically. That specificity is their moat.

Find your specific segment. Own it completely. Then expand adjacent.

Their positioning sums it up perfectly:

“We’re not trying to replace kiranas. We’re empowering them.”

Startup #6: Navi Technologies – Fintech’s profitability story

Tagline & mission

“Financial services for every Indian.”

Navi is the fintech unicorn that actually makes money. In an industry full of loss-making companies, that’s practically revolutionary.

The problem they solved

Most Indians are underserved by financial services.

Banks don’t want to lend to them (too risky, too small). Existing fintech products are fragmented (one app for loans, another for insurance, another for UPI).

Navi said: “What if we built one platform for all financial needs?”

Unique value proposition & business model

Navi offers personal loans, home loans, mutual funds, insurance, and UPI, all within one unified app.

The smart twist?

Instead of lending or underwriting themselves, Navi partners with NBFCs, insurers, and fund houses, becoming the customer-facing layer.

That means:

✅ Commissions on every transaction

✅ Recurring revenue

✅ Lower operational risk

The business model forces profitability because they’re not actually lending or insuring, they’re connecting customers to lenders.

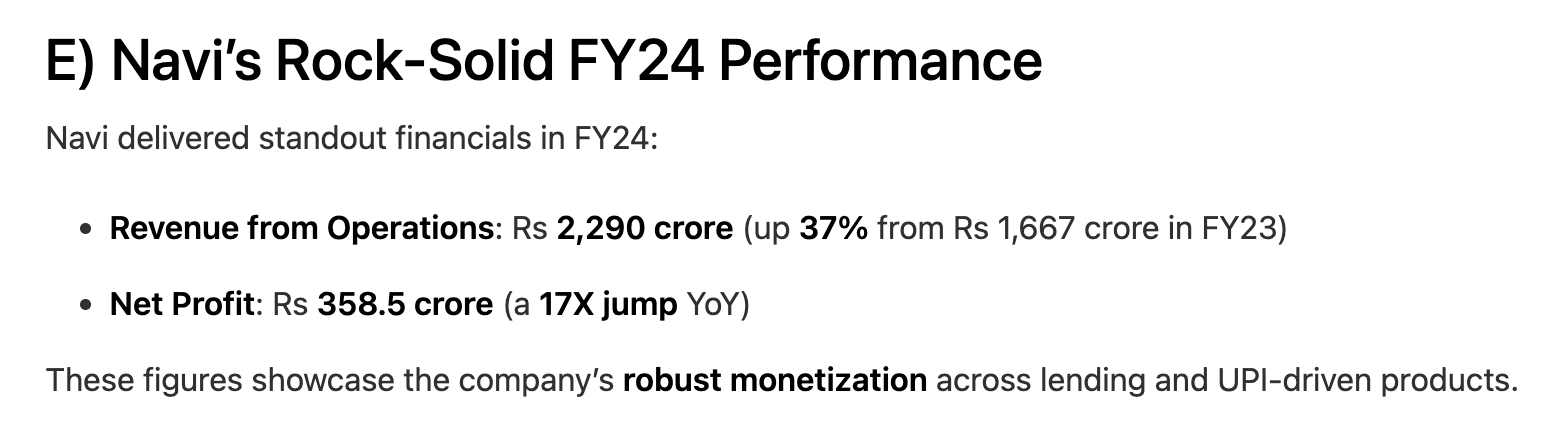

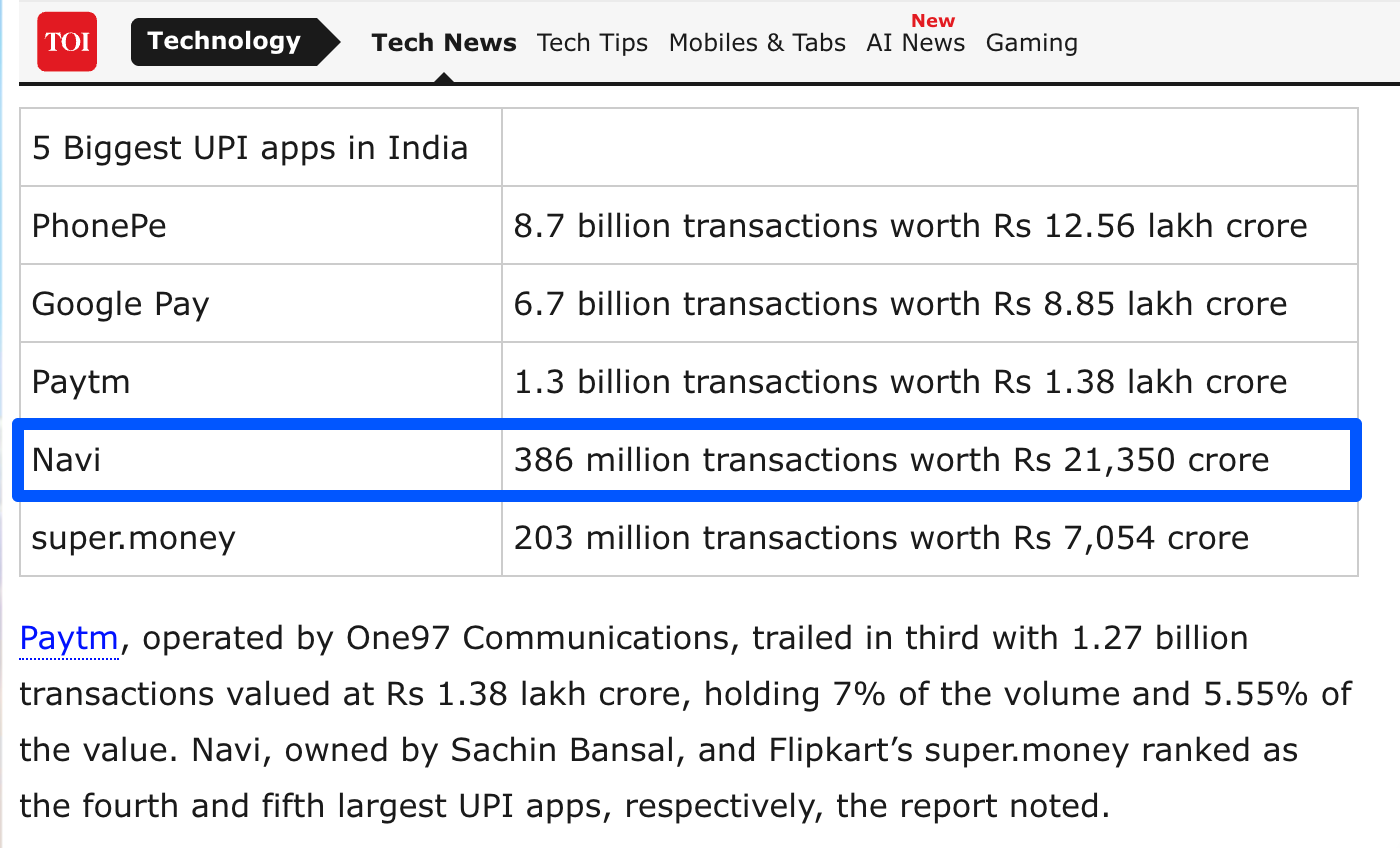

Growth metrics

- Valuation: $1B+ (unicorn status)

- Revenue (FY24): ₹2,290 crore (+37% YoY)

- Net Profit (FY24): ₹358.5 crore (17x YoY growth)

- UPI Ranking: 4th largest in India

- UPI Volume: 406M transactions worth ₹21,815 crore

- Users: 5M+ active

Look at those financials again.

37% revenue growth + 17X profit jump. That’s not a startup. That’s a business.

Recent milestones

→ Raised ₹170 crore in debt funding (not equity—that’s key)

→ Climbed to 4th largest UPI app in India

→ Launched personal finance advisory services

→ Attracted institutional debt investors (clear trust in model)

→ Filed for IPO (expected 2026–2027)

Why they’re worth watching in 2026

Fintech is overcrowded.

Every other week, there’s a “new app for payments or credit.”

But Navi is one of the few actually making money. That’s rare. That’s real.

Also, their UPI ranking (4th) shows network effects.

More users → More transaction volume → More profitable.

If their IPO goes through in 2026, it could redefine what sustainable fintech growth looks like in India.

Growth lesson for founders

Profitability beats hype. Every single time.

Navi didn’t chase vanity metrics or mega-rounds.

They built a profitable, scalable unit and let the numbers speak.

Most founders are hooked on VC capital.

Navi proved that you can build a fintech unicorn without burning through it.

Their positioning says it all:

“We’re not another app. We’re your financial control center.”

Startup #7: Ather Energy – The EV mopeds & infrastructure play

Tagline & mission

“Make electric mobility the default choice.”

Ather Energy bet that electric two-wheelers would dominate India before electric cars. They were right. And they’re building the infrastructure to prove it.

The problem they solved

India’s mobility problem isn’t just traffic, it’s pollution and cost.

Cars are expensive. Public transport is patchy.

And two-wheelers? They’re the real way India moves.

But almost all of them run on petrol.

Ather asked a bold question:

“Why not electric?”

The challenge?

High upfront cost, poor charging infrastructure, and short battery range.

So Ather didn’t wait for others to fix it.

They built the scooter, then built the charging network to power it.

That’s the definition of full-stack innovation.

Unique value proposition & business model

Ather Energy designs and builds premium electric scooters (₹1–1.5L range) and operates Ather Grid, its fast-growing charging network.

The scooters are smart: software updates, theft alerts, geofencing, and app integration.

The grid is convenient: 200+ fast chargers placed strategically across cities.

Their business model:

- Scooter sales (hardware revenue)

- Charging network (subscription + per-charge fees)

That’s the ecosystem approach.

Growth metrics

- Funding: $186.5M across 4 rounds

- Revenue (FY24): ₹1753.8+ crore (vs ₹35.3 crore in 2020)

- Growth: 80x in four years

- Charging stations: 200+ Ather Grid locations (expanding fast)

- Market share: Dominates India’s premium e-scooter segment

- Customers: 250,000+ loyal Ather owners

Recent milestones

→ Launched Ather 450X (flagship model)

→ Expanded Ather Grid to 200+ stations

→ Partnered with IOCL for nationwide charging access

→ Announced Southeast Asia expansion (Thailand launch first)

→ Reported 80%+ customer satisfaction

Why they’re worth watching in 2026

EV adoption in India is accelerating. Two-wheeler EV market is projected to hit 35-40% penetration by FY31 (2031), according to Ather Energy’s base and optimistic scenarios.

Ather is the category leader. Their brand is cool. That’s rare for EVs.

More importantly, they’re building an infrastructure moat through Ather Grid, a network competitors can’t replicate overnight.

In 2026, all eyes are on Ather’s international expansion into Thailand, Vietnam, and Indonesia because markets are hungry for affordable EVs.

Growth lesson for founders

Hardware needs software. EVs need infrastructure. Bread needs butter.

Your product alone isn’t enough, your ecosystem is your real moat.

Ather understood this early. They didn’t just sell scooters; they built a platform for the future of mobility.

Their positioning says it all:

“The future of mobility is electric. And it looks like Ather.”

Startup #8: LeadSquared – The high-velocity SaaS unicorn that’s crushing sales automation

Tagline & mission

“Accelerate revenue growth for high-velocity teams, wherever they work.”

LeadSquared isn’t just another CRM. It’s the engine behind India’s fastest-growing sales teams, built to handle the chaos of scaling leads, reps, and revenue.

The problem they solved

Bangalore’s startup scene is full of ambitious sales teams. But when you’re juggling thousands of leads and dozens of reps, things break fast.

Traditional CRMs? Clunky. Slow. Built for a pre-AI era.

LeadSquared saw the gap: businesses didn’t need another dashboard, they needed a revenue machine.

Their question was simple:

“Why do most CRMs slow down high-velocity teams instead of powering them?”

Unique value proposition & business model

LeadSquared built a full-stack, AI-powered sales execution and marketing automation platform designed for speed and scale.

What it does:

- Auto lead capture from every channel (web, mobile, call centers, offline)

- Workflow automation from lead to deal (no manual follow-ups)

- Vertical-specific features for EdTech, BFSI, Healthcare, Real Estate, and Automotive

- Next-gen tools: AI chatbots, event automation (FloStack), and modular dashboards

Their business model is B2B SaaS subscription. Whether it’s a 5-person EdTech startup or a 2,000-person insurance enterprise, LeadSquared can scale with you, up or down easily.

And here’s the kicker: their stack supports thousands of concurrent users, millions of leads, and real-time performance tracking across every level of the funnel.

Growth metrics

- Total funding: $205M+ to date (Series C: $153M in 2022 led by WestBridge Capital)

- Valuation: $1B+ (India’s newest SaaS unicorn)

- Revenue (FY25): ₹366.3 crore (+13% YoY)

- Operating revenue: ₹326.2 crore (+14%)

- Net loss: Reduced 45% YoY to ₹89.2 crore

- Clients: 2,000+ across 40 countries (Practo, BYJU’S, OLX, Exide Life, Kotak, Bharti AXA, Cars24)

- Team: 1,000+ employees (Bangalore HQ + global offices in NJ, Manila, South Africa, Australia, Indonesia)

- New products: AI modules, smart chatbots, and customizable dashboards launched in 2026

- Global expansion: North America and APAC markets next

That’s growth with discipline, a rare combo in SaaS.

Recent milestones

→ Joined India’s unicorn club ($153M Series C, 2022)

→ Expanded to 2,000+ enterprise clients in 40+ countries

→ Launched LeadSquared NextGen and FloStack for event automation

→ Rolled out AI chatbot suite + advanced dashboards

→ Trimmed net loss by 45% YoY while scaling revenue

→ Accelerated expansion into APAC and EMEA regions

Why they’re worth watching in 2026

LeadSquared isn’t fighting global SaaS giants like Zoho or Salesforce, it’s out-executing them where it matters: in high-velocity, industry-specific sales environments.

They’re building the digital backbone for India’s fastest-moving sectors like EdTech, BFSI, and Healthcare and helping businesses handle millions of leads daily without chaos.

Growth lesson for founders

Build for scale from day one. LeadSquared’s system doesn’t choke at 10,000 leads, it thrives there.

Verticalize your SaaS. Every big win came from tailoring workflows to specific industries like BFSI or EdTech.

Respect India’s complexity. Their CRM fits compliance, integrations, and regional workflows seamlessly.

Invest in real innovation. LeadSquared launched AI upgrades, smart forms, and modular dashboards based on user feedback, not hype.

Control your burn. A 45% YoY loss reduction while scaling revenue is discipline in action.

LeadSquared isn’t just riding the SaaS wave. They’re building it.

If you’re a founder aiming to grow fast and sustainably, this is the playbook to study in 2026.

Startup #9: Sprinto – Compliance tech for SaaS

Tagline & mission

“Compliance on autopilot.”

Sprinto turns months of manual work into a few clicks by automating compliance processes (SOC 2, ISO 27001, GDPR, HIPAA).

In the SaaS world, compliance is non-negotiable. Sprinto makes it painless.

The problem they solved

As SaaS startups scale, compliance becomes a dealbreaker.

You can’t sell to enterprises without SOC 2.

You can’t target EU customers without GDPR.

You can’t pass investor due diligence without ISO 27001.

But traditional compliance process is a long journey. You need to hire consultants that cost $50K+ a year, and internal setups drag on for months.

Sprinto asked:

“What if we automated all of it?”

Unique value proposition & business model

Sprinto built software that connects to your infrastructure including cloud servers, databases, tools, monitors compliance requirements, and generates documentation automatically.

Their business model is clean SaaS:

- Subscription pricing: $300–3,000/month (depending on tier)

- Target market: High-growth SaaS startups and scale-ups

- Revenue drivers: Recurring usage + multi-standard compliance

Instead of hiring a consultant, you just log into Sprinto.

Same outcome. 10x faster. 10x cheaper.

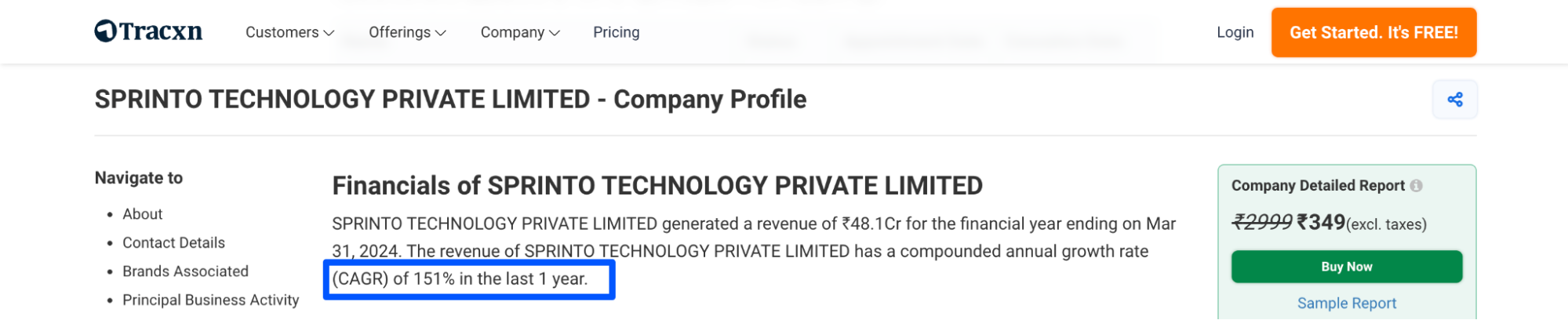

Growth metrics

- Funding: Series B (recent, undisclosed amount)

- Customers: 100+ SaaS startups and scale-up

- Growth: 150%+ YoY

- Primary markets: India + expanding rapidly into the US

- Pricing range: $300–3,000/month

Sprinto is quietly becoming the go-to compliance layer for India’s global SaaS wave.

Recent milestones

→ Launched US compliance modules

→ Closed Series B round

→ Crossed 100 customers

→ Expanded coverage to HIPAA, GDPR, SOC 2, ISO 27001

→ Founder featured in startup media as a thought leader in compliance tech

Why they’re worth watching in 2026

As every Indian SaaS company wants to go global, compliance is the wall (#1 blocker) they hit their head.

Sprinto breaks that wall.

They’re infrastructure for the infrastructure.

Plus, they’re positioned at the intersection of three unstoppable waves:

⚙️ The AI wave (automation),

💻 The SaaS wave (subscriptions),

🧩 The compliance wave (global regulations).

Sprinto has already established a presence in San Francisco and opened its Utah office in 2022. With Series B funding focused on expanding into new markets, the company is positioned to grow its US presence further.

Growth lesson for founders

Build tools for other builders. Infrastructure plays have massive moats.

Everyone depends on you. High switching costs. Sticky revenue.

Their positioning sums it up perfectly:

“Security compliance, automated. No consultants needed.”

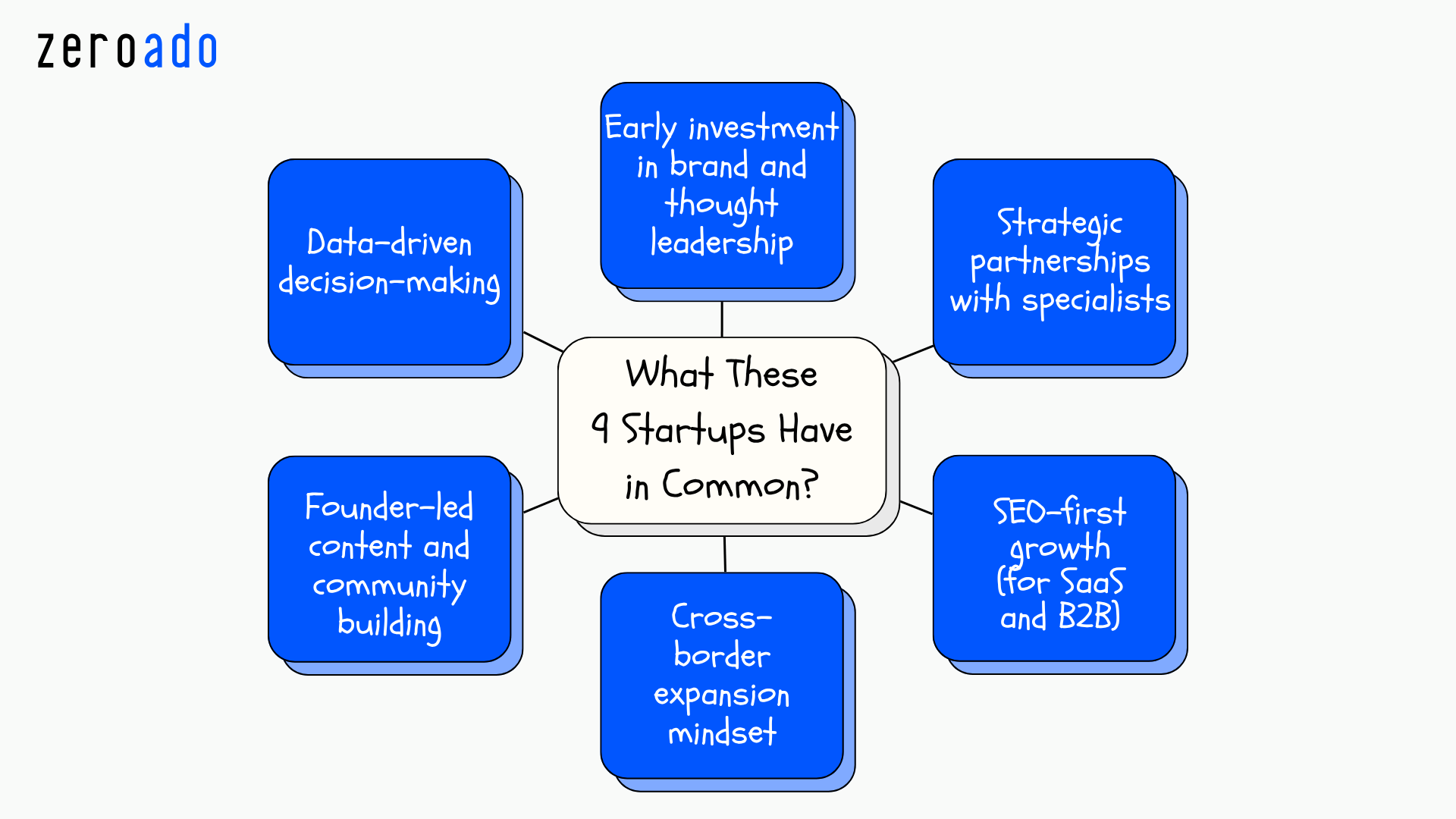

Comparative analysis: What these 9 startups have in common

I just introduced 9 very different startups.

One moves people.

One moves groceries.

One automates compliance.

Another powers SaaS sales at scale.

So what connects a bike-hailing app, an AI studio, and a compliance automation platform?

If you can spot the patterns behind their growth, you can replicate them.

Pattern #1: Data-driven decision-making

Every one of these startups treats numbers as their north star.

They track CAC, LTV, unit economics, churn, and repeat rates relentlessly.

No gut calls. Only metrics.

Rapido grew 40% YoY while cutting losses by 45%.

Navi scaled profits 17x while keeping costs flat.

LeadSquared focused on profitability and revenue quality, trimming losses by 45% even as they expanded globally.

That’s what separates hype from health, discipline through data.

Pattern #2: Early investment in brand and thought leadership

These startups aren’t anonymous.

Rapido is known. Ather is loved. Darwinbox’s founders are now global HR voices.

Navi’s founder, Sachin Bansal, carries Flipkart-level trust.

LeadSquared’s leadership actively shares product updates and GTM insights with the SaaS ecosystem.

They didn’t just build products, they built credibility early.

Most founders skip this step, thinking product is enough. It’s not. Building brand credibility early often comes from partnering with the best digital marketing agencies in Bangalore, the ones that know how to turn visibility into trust and trust into growth.

Pattern #3: Strategic partnerships with specialists

Every one of these companies knows how to collaborate.

Darwinbox partnered with global consultants for US expansion.

Jumbotail acquired Solv to enhance fintech capabilities.

Ather partnered with IOCL for charging distribution.

They move faster because they don’t try to do everything alone.

Pattern #4: Founder-led content and community building

Navi’s founder actively educates on fintech.

Ather built one of India’s most loyal EV communities.

Darwinbox leads conversations on modern HR.

LeadSquared fosters a strong founder-led content culture by sharing playbooks for SaaS growth, automation, and revenue scaling.

They’re not just building user bases, they’re building tribes so called communities.

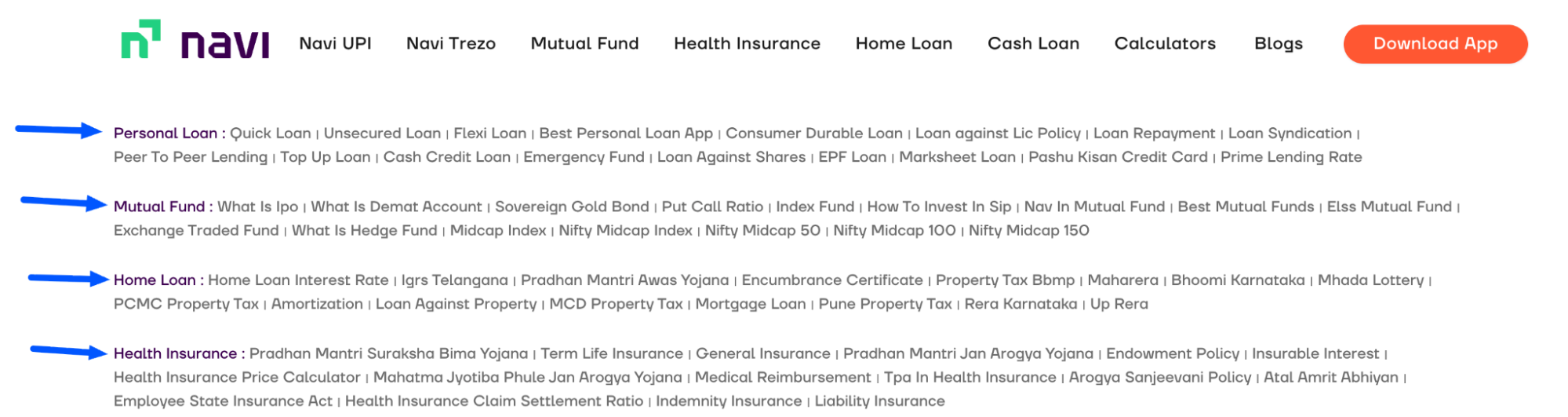

Pattern #5: SEO-first growth (for SaaS and B2B)

Darwinbox, Jumbotail, LeadSquared, and Sprinto all dominate their categories on Google.

They didn’t rely on ads. They built long-term inbound momentum through B2B SEO, content marketing, and backlinks.

It’s the kind of growth playbook refined by the top startup SEO agencies and proven to compound quietly over time.

Pattern #6: Cross-border expansion mindset

Rapido’s looking at Southeast Asia.

Darwinbox is already in 116 countries.

Ather’s setting up in Thailand.

Navi is prepping for IPO-level growth.

Each one is thinking global, not local.

The common thread

They all treat growth as a function, not an afterthought.

Most startups spend 90% of their energy building product, and 10% telling the world about it. These nine and of course others which are not listed here flipped that ratio.

They invest in positioning, SEO, storytelling, partnerships, and brand building with the same rigor they invest in product design.

That’s why they’re scaling sustainably while others stall.

Growth strategies these startups used to scale

These 9 startups didn’t grow by accident.

They followed a playbook. Different details, but similar structure.

Here’s the blueprint:

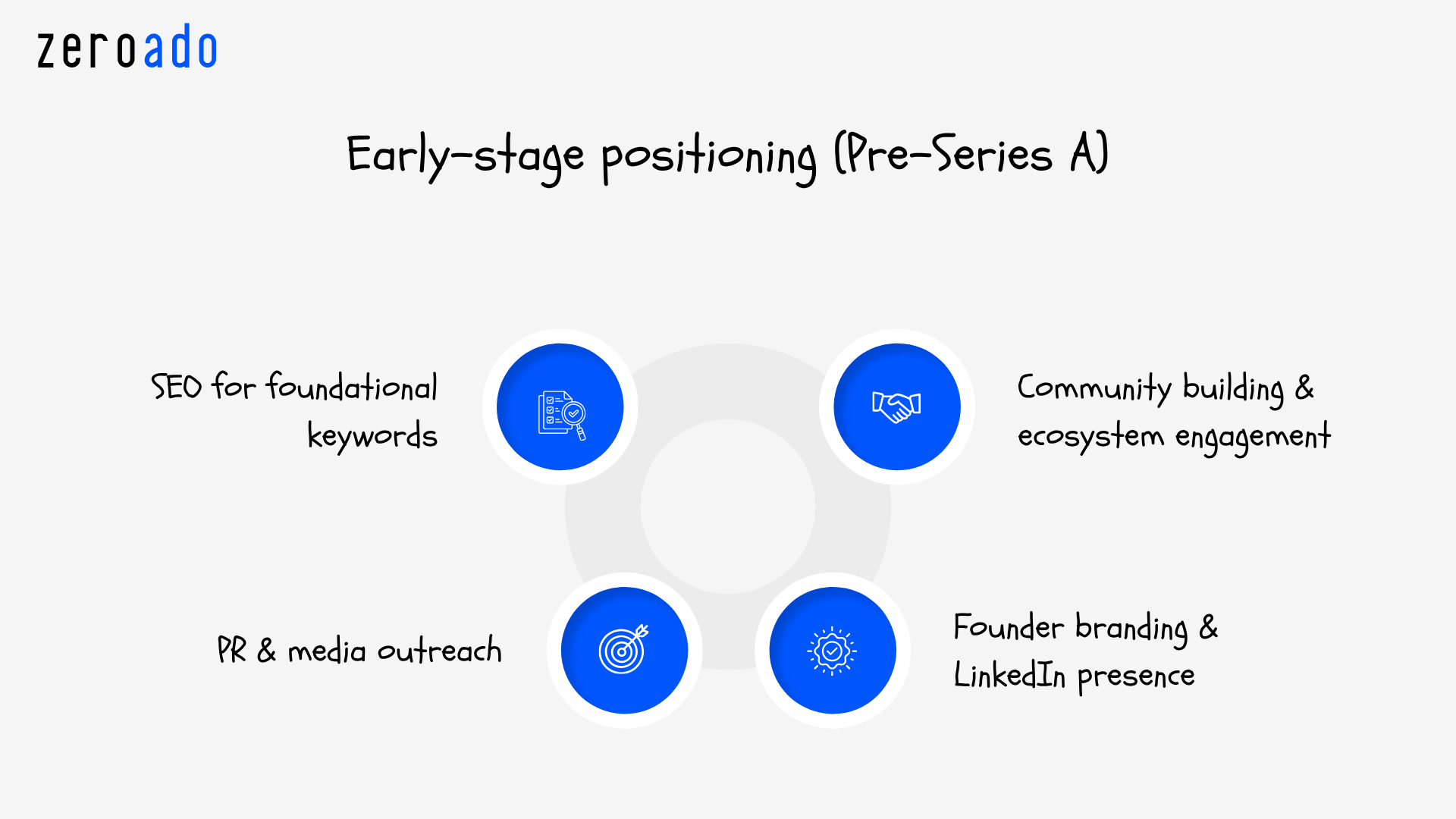

Early-stage positioning (Pre-Series A)

Founder branding & LinkedIn presence

The founder becomes the face. Rapido’s founder, Navi’s founder—they’re known, not anonymous. This builds trust and attracts talent.

Community building & ecosystem engagement

Joining accelerators, speaking at conferences, hosting meetups. Getting visible early.

SEO for foundational keywords

Creating blog SEO content that ranks for problem-based keywords. “How to hire quickly?” (for HR tech). “How to deliver fast?” (for logistics).

PR & media outreach

Getting stories into TechCrunch, Economic Times, Inc42. Validation through media.

Example: Sprinto did all of this before Series B. That’s why they won Series B easily.

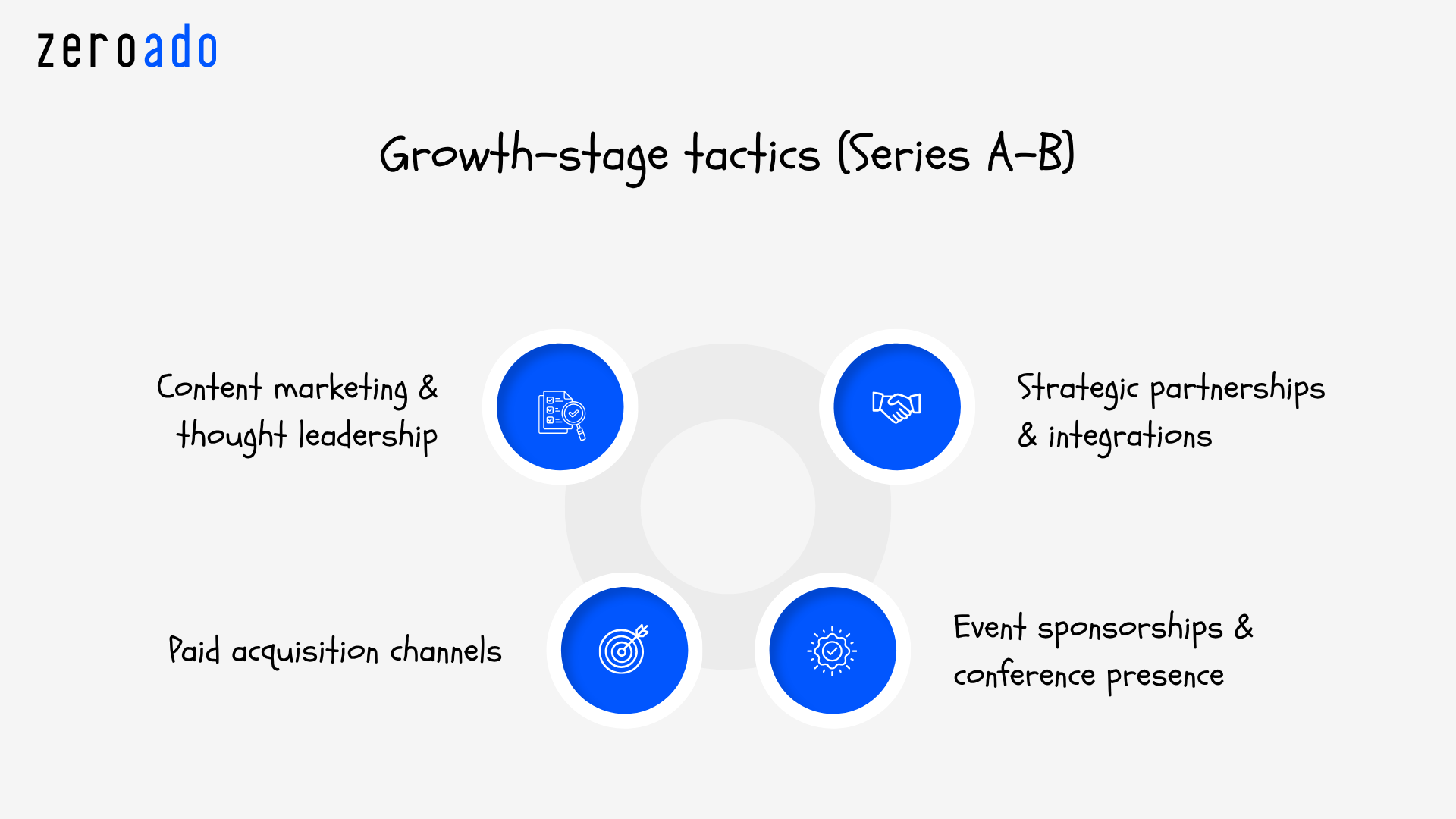

Growth-stage tactics (Series A-B)

Content marketing & thought leadership

Publishing reports, frameworks, original research. Darwinbox does this relentlessly.

Strategic partnerships & integrations

Building integrations with complementary tools. If you’re HR tech, integrate with payroll tools, HRIS, etc.

Paid acquisition channels

Google Ads for high-intent keywords. LinkedIn ads for B2B. Programmatic ads for consumers.

Event sponsorships & conference presence

Becoming visible at industry events.

Example: Darwinbox sponsored HR conferences. That’s how they became the #1 platform.

Scaling strategies (Series C+)

Brand marketing & category creation

Moving from “product marketing” to “brand marketing.” Positioning yourself as the leader, not a player.

International expansion & localization

Going global but localizing for each market.

Influencer & advocate programs

Building real fans. Because customers who love your brand so much, they naturally talk about it and recommend it to others.

M&A strategies

Buying smaller players or complementary tools helped them grow faster.

Example: Rapido acquired local delivery startups. Jumbotail bought Solv for fintech capabilities.

The key lesson

Many founders spend too long building product and ignore growth early.

But the ones who invest in positioning, SEO, and brand building early, sometimes with help from the best go to market agencies raise money faster, often 3–6 months earlier.

Because when you already have visibility and credibility, investors come to you.

That’s the power of building your brand before you start scaling.

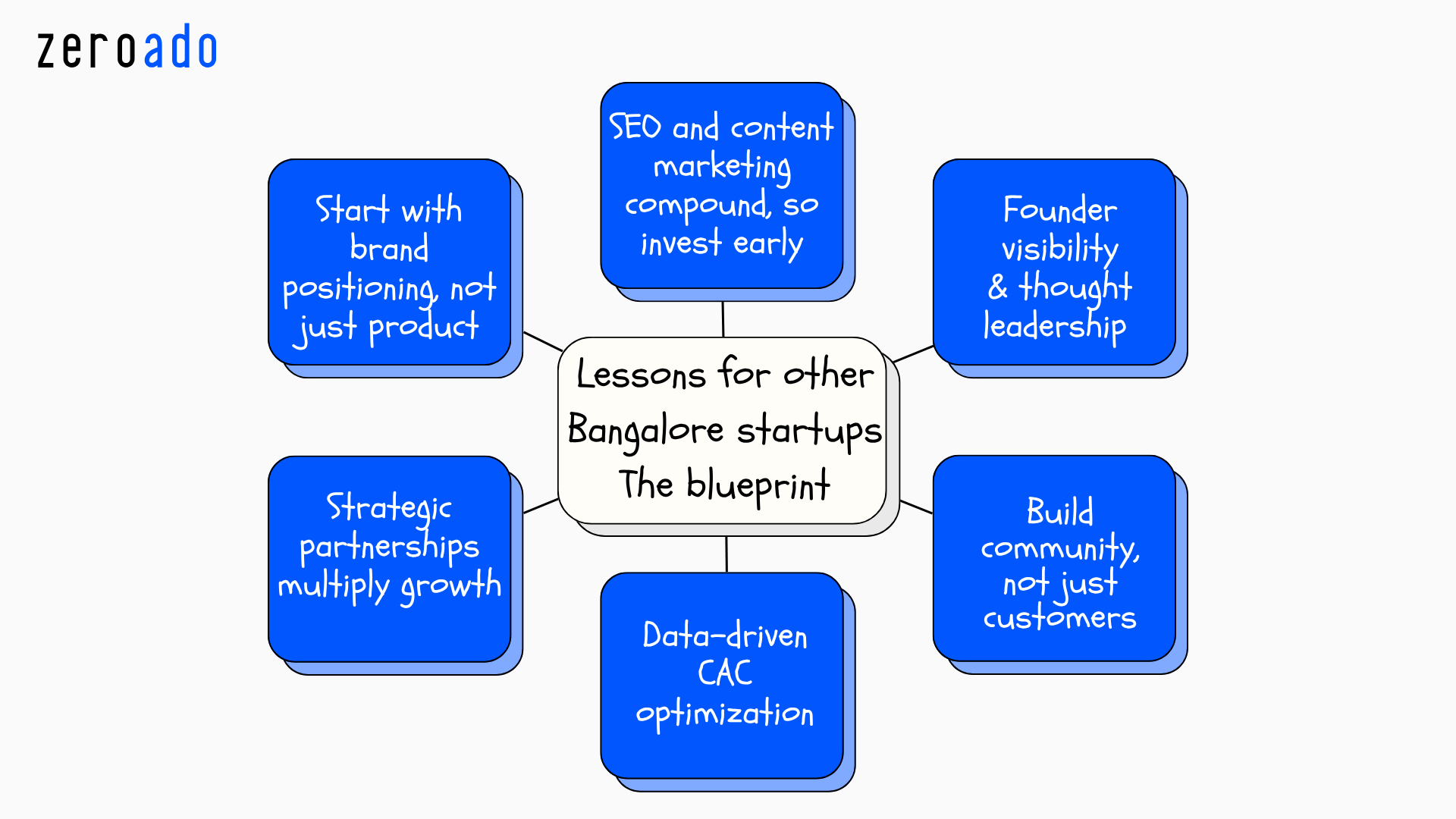

Lessons for other Bangalore startups: The blueprint

If you’re building a startup in Bangalore, here are six lessons these nine founders figured out early, and used to win.

Lesson 1: Start with brand positioning, not just product

Your product is the entry ticket. Everyone builds good products.

What separates the winners is positioning.

Rapido didn’t call itself “a mobility app.” They said, “We’re India’s bike-hailing experts.”

LeadSquared didn’t say “we’re a CRM.” They said, “We help high-velocity sales teams scale faster.”

Specific category. Specific promise.

Most startups stay too broad. Pick your wedge, own it, then expand.

Lesson 2: SEO and content marketing compound, so invest early

SEO and content marketing is the most ignored growth channel, yet the most powerful one.

One strong blog post can rank for years.

Fifty well-optimized articles? That’s fifty long-term traffic sources.

Darwinbox, Sprinto, and Jumbotail did this early.

Today, their organic traffic fuels growth without massive ad spend.

Lesson 3: Founder visibility & thought leadership accelerate fundraising

When you go to raise your Series A, investors should already know your name.

Sachin Bansal had credibility from Flipkart, which gave Navi instant trust.

Darwinbox’s founders built public authority through HR events and insights.

If you’re an unknown founder, build visibility first with your writing, speaking, and sharing progress.

Investors back people as much as products.

Lesson 4: Strategic partnerships multiply growth

Rapido partnered with Prosus.

Jumbotail acquired Solv.

Ather tied up with IOCL for charging expansion.

Each move expanded their reach without proportional marketing spend. It is the same idea top B2B agencies in Bangalore follow when they help brands grow through partnerships, integrations, and ecosystem leverage.

That’s how you grow smarter, not harder.

Lesson 5: Data-driven CAC optimization separates fast-growing startups from the rest

Know your CAC. Know your LTV. Optimize the ratio obsessively.

Most startups are sloppy here. They just spend on ads and hope.

Winners track every penny.

Lesson 6: Build community, not just customers

Your best marketing channel is your happiest customer.

Ather built a strong scooter owners’ community.

Darwinbox created a hub for HR professionals.

These communities create advocates who sell for you, no ad budget required.

Rate your startup against these 6 factors checklist

- Do you have clear market positioning? (Yes/No)

- Are you investing in SEO content? (Yes/No)

- Is your founder visible in the ecosystem? (Yes/No)

- Do you have strategic partnerships? (Yes/No)

- Are you tracking CAC and LTV religiously? (Yes/No)

- Do you have customer advocates/community? (Yes/No)

The road ahead: What’s next for Bangalore startups

Alright, we’ve covered the past and the present.

So what’s coming next for Bangalore’s startup scene?

2026–2027 predictions

SaaS consolidation

Smaller SaaS players will get acquired by larger ones. Winners will dominate. Also-rans will disappear.

AI goes mainstream

Not “build AI,” but “add AI to existing products.” Darwinbox did this with PROSE. Others will follow.

Global expansion

Ather to Southeast Asia. Navi to IPO (which means global ambitions). Darwinbox expanding US. The best startups are going global by 2026.

Profitability over growth

The growth-at-any-cost era is done. Every investor now wants proof of unit economics.

Regulatory shifts

Data localization requirement

This will actually help Indian startups because foreign companies will struggle with compliance.

AI regulation

More regulations around AI use. Compliance tech becomes critical.

Startup-friendly tax policies

Government programs like ELEVATE 2024 are already making it easier for startups to grow.

All these changes create new opportunities for founders who can adapt quickly.

Funding landscape

Expect funding to become more selective.

VCs will fund:

- Startups with unit economics proof

- Founders with track record

- Companies serving real problems at scale

Vanity metrics and hype no longer work.

Opportunity gaps

Where are the problems not solved?

→ Last-mile logistics: Indian logistics is still inefficient. Opportunity here.

→ Healthcare infrastructure: Only 0.6 doctors per 1000 people. Massive opportunity.

→ Financial inclusion: 190 million unbanked Indians. Fintech opportunities.

→ Agricultural tech: Farmers still struggle with market access. AgriTech startups can win big.

→ And maybe… the idea you’re already thinking about.

The one that keeps you awake at night. The one you know should exist.

Because every unicorn on this list started exactly there: one founder, one pain point, and one idea that refused to stay quiet.

The takeaway

Want to build the next unicorn?

Start here:

- Pick one clear problem.

- Prove your unit economics early.

- Invest in positioning from day one.

- Be visible. Build in public.

- Track your numbers like your life depends on it.

That’s it. That’s the playbook.

How will you join the next wave of Bangalore startups?

We just explored nine startups that are shaping Bangalore’s future.

From mobility (Rapido) to HR tech (Darwinbox) to compliance automation (Sprinto), each one shows how far India’s startup ecosystem has evolved: smarter, faster, and more focused on results.

But here’s what really stands out.

These founders didn’t win because they raised money.

They won because they executed with intent.

They solved real problems, tracked the right numbers, built recognizable brands, and treated growth as a skill, not luck.

Most founders don’t. They spend years perfecting their product but never master positioning, SEO, or brand storytelling. That’s the missing piece.

Bangalore’s dominance isn’t an accident. It’s built on:

→ Deep tech talent

→ Access to capital at every stage

→ A mature ecosystem of support services

→ Founders who learn from each other’s wins

If you’re building in Bangalore, investing early in positioning, SEO, and visibility gives you a massive edge.

These nine founders did it, and it worked.

Here’s your next step:

Book a free 30-minute growth audit and we’ll assess your startup across the six key growth factors that predict success.

Because the founders who act on these insights now?

They’ll be the ones on next year’s list of Top Startups in Bangalore to Watch.

To Bangalore’s next unicorn. 🚀

Frequently asked questions about startup companies in Bangalore

It depends on what you’re looking for. Rapido leads in mobility, Darwinbox dominates HR tech, Navi stands out in fintech, and Ather Energy is transforming EV mobility. If you’re after pure innovation, Ai.tech is India’s fastest bootstrapped AI unicorn. Each one represents a different strength, but together, they show why Bangalore is the best city in India to build and scale a startup.

It’s a mix of both. Startups like Rapido ($2.3B), Darwinbox, Navi, Jumbotail, LeadSquared, and Ather Energy have already crossed unicorn status. Others like Ai.tech and Sprinto are fast approaching that mark. Every company on this list is high-growth, well-funded, and shaping its industry in 2026.

All of them focus on unit economics over vanity metrics, invest early in brand positioning, build strategic partnerships, obsess over data-driven decisions, and founder-led thought leadership. They’re not just building products, they’re building movements. That discipline separates winners from also-rans.

Even if you’re not investing, these startups show how to build and scale successfully. Whether you’re a founder, marketer, or just curious about India’s tech scene, you’ll learn real lessons on growth, positioning, and execution. Plus, they’re shaping the ecosystem right here in Bangalore, you should know who’s leading the charge.

Pick a specific market wedge and dominate it first (don’t try to do everything). Invest in SEO and content marketing from day one, it compounds. Get your founder visible (speaking, writing, building in public). Track CAC and LTV obsessively. And remember: profitability matters more than hype.

Three reasons: (1) Massive concentration of tech talent—1M+ professionals; (2) Access to capital—VCs actually live here and move fast; (3) Network effects—every founder knows someone who exited or raised money, so you learn from winners. Add government support (ELEVATE program) and infrastructure maturity, and Bangalore becomes the obvious choice.