You have a solid idea. A team that is all in. Early signs of product market fit are showing. But to truly scale, you need capital. And more importantly, you need capital from the right people.

Not all venture capital firms in Bangalore are the same. Some move fast. Some disappear after the first meeting. And some genuinely help founders build, hire, grow, and raise the next round, not just write a cheque.

Bangalore is India’s startup capital for a reason. From fast-growing startups and experienced entrepreneurs to active incubators and accelerators, the ecosystem is built to help founders scale.

If you are a founder in Bangalore planning to raise funds in 2026, this guide is for you. This is not a random list pulled from Crunchbase. These are venture capitalists in Bangalore who actively back startups, understand founder challenges, and have a real track record of helping companies grow.

By the end of this article, you will know which VC firm fits your startup, how to approach them, and what they actually look for before investing. No theory. Just practical, actionable information.

Let’s get started.

- How we selected the top VC firms in Bangalore

- 9 top venture capital firms in Bangalore that actively back startups

- Angel investors vs. venture capital firms in Bangalore

- What venture capital firms in Bangalore actually look for in startups

- How to approach VC firms in Bangalore (founder tips)

- Bangalore vs. other VC hubs in India

- So, where do you go from here with venture capital firms in Bangalore?

- Handpicked Articles for You

- FAQs on venture capital firms in Bangalore

How we selected the top VC firms in Bangalore

Before jumping into the list, it is important to explain how these venture capital firms in Bangalore were shortlisted.

This is not a popularity list. It is based on relevance for founders who are actively building and fundraising.

Investment stage focus

We only included VC firms that actively invest in Seed to Series A startups. This is where most first-time founders in Bangalore are raising capital.

If your startup is already at Series B or beyond, the criteria and investor expectations are very different. This list is built for early-stage and growth-stage founders.

Recent startup investments

We focused on firms that are actively investing in 2024 to 2026.

Not funds that peaked years ago or have gone quiet. These VC firms are currently deploying capital, backing new founders, and participating in fresh rounds across the Bangalore startup ecosystem.

Founder support beyond capital

Capital alone does not build a company.

The VC firms on this list are known for supporting startups beyond the cheque. That includes:

- Founder mentorship

- Strategic guidance

- Introductions to customers and talent

- Support in follow-on funding rounds

These are the venture capitalists in Bangalore that founders actually want on their cap table.

Strong Bangalore or India startup focus

Every firm listed here either has a physical presence in Bangalore or a deep, long-term focus on Indian startups.

They understand the local market, hiring challenges, customer behaviour, and scale dynamics. These are not investors parachuting in for one-off deals. They are long-term players in the Indian startup ecosystem.

9 top venture capital firms in Bangalore that actively back startups

These are VC firms in Bangalore that do more than just invest. They actively work with founders, support growth after funding, and understand what it takes to scale a startup in the Indian market. If you are serious about fundraising in 2026, this is where you should start.

3one4 Capital

3one4 Capital is one of the most active early-stage venture capital firms in Bangalore. They focus on tech-enabled startups solving real, meaningful problems. The firm is known for backing founders who are deeply customer-obsessed rather than chasing short-term hype.

Where and how they invest

3one4 primarily invests at the seed and Series A stages. Typical cheque sizes range from $0.5 million to $5 million (approximately ₹4 crores to ₹42 crores) with a median of $1.5 million to $3 million.

Their core focus areas include SaaS, fintech, marketplaces, and consumer tech.

Startups they’ve backed

Their portfolio includes startups like Ather Energy, Licious, Kuku FM, Yulu, and Darwinbox, spanning both B2B and consumer-focused businesses.

Why founders like working with them

3one4 is known for being hands-on at the early stage. The team actively supports founders with:

- Startup strategy and positioning

- Hiring and team building

- Pitch refinement and fundraising prep

They also have a reputation for quick decision-making, which matters a lot when founders are fundraising.

Is 3one4 Capital right for your startup?

If you are building a tech startup, have early traction (users or revenue), and are raising between ₹50 lakhs to ₹3 crores, 3one4 Capital is a strong fit and worth approaching.

Kalaari Capital

Kalaari Capital is one of India’s pioneering venture capital firms. Founded by Director Vani Kola in 2006, they have been backing startups long before “startup” became a buzzword. The firm is known for its deep understanding of Indian consumer behaviour, technology adoption, and long-term market building.

Where and how they invest

Kalaari invests from Seed to Series B, with strong activity at the early stage.

Their primary focus areas include consumer tech, SaaS, fintech, and healthcare.

For example, they recently led a $1.2 million seed round for SuperBryn.

Startups they’ve backed

Kalaari’s portfolio includes some of India’s most iconic startups, such as Dream Sports (Dream11), Upstox, CRED, WinZO, BlueStone, and Cult.fit. Alongside these large successes, they are actively backing over 158 companies, with 9 to 17 new investments made in just the last 12 months.

Why founders like working with them

Kalaari brings significant brand credibility. When Kalaari backs a startup, other investors pay attention.

Founders also benefit from:

- A strong mentor and operator network

- Reliable follow-on funding support

- Experience across both Indian and global markets

Is Kalaari Capital right for your startup?

Kalaari is a strong fit if you are raising a Series A round or have meaningful traction in terms of revenue or user growth. They may also participate in larger seed rounds when the founding team or market opportunity stands out.

Accel India

Accel India is part of Accel, a global venture capital firm with over $31.1 billion (as of March 2025) in assets under management. They are known for identifying India’s next unicorns at an early stage. While Accel invests across India, Bangalore is a major hub for their startup investments.

In January 2026, Accel launched its eighth early-stage fund for India and Southeast Asia with a corpus of $650 million, specifically targeting AI and deep tech startups.

Where and how they invest

Accel primarily invests at the seed and Series A stages, with a strong emphasis on follow-on funding as companies scale.

Their key focus areas include fintech, SaaS, enterprise software, and marketplaces. Apart from these, they also prioritized AI/DeepTech, SpaceTech, Defense, and Industry 5.0 manufacturing.

A key part of Accel’s early-stage strategy is Accel Atoms, their formal pre-seed program. Through Accel Atoms, Accel backs founders at the idea or very early traction stage and works closely with them to shape product, go-to-market, and early hiring.

For AI-focused startups, Accel Atoms runs a dedicated cohort in partnership with the Google AI Futures Fund, where Accel co-invests up to $2 million per company.

Startups they’ve backed

Accel’s portfolio includes some of India’s most successful startups, such as Flipkart, Myntra, Byju’s, and Freshworks. In recent years, they have also been active across fintech and financial services, including partnerships with Shriram Finance and multiple early-stage fintech startups.

Why founders like working with them

Global access is a major advantage with Accel. Founders benefit from:

- A strong international network across the US, Europe, and Asia

- Support with global expansion and market entry

- A strong brand reputation that attracts follow-on investors

- Fast decision-making and reliable capital support

Is Accel India right for your startup?

Accel is a strong fit if you are building a highly scalable startup in fintech, SaaS, or enterprise software and are raising a Series A round. They also participate in seed rounds for exceptional teams with strong early signals.

Peak XV Partners (formerly Sequoia Capital India & SEA)

Peak XV Partners is one of the most prestigious and influential venture capital firms in India and Southeast Asia. The firm rebranded from Sequoia Capital India & SEA to Peak XV Partners in June 2023, marking its transition into an independent global investment platform.

They are widely regarded as having some of the deepest venture capital expertise and capital reserves in the region, with a long-term approach to building category-defining companies.

Where and how they invest

Peak XV invests from Seed to Series C and beyond, with strong activity at both early and growth stages.

Their core focus areas include fintech, SaaS, consumer internet, enterprise software, and increasingly deep tech and AI.

They are known for backing companies early and continuing to support them through multiple funding rounds, often all the way to IPO.

Startups they’ve backed

Peak XV’s portfolio includes some of India’s most iconic startup success stories, such as Zomato, Pine Labs, Razorpay, CRED, Unacademy, Mamaearth, and Freshworks.

Rather than spreading thin, the firm is known for building deep conviction positions in a smaller number of high-potential companies.

Why founders like working with them

Peak XV brings unmatched scale and long-term backing. Founders value them for:

- Strong brand credibility that instantly signals quality

- Deep pockets to support companies across multiple rounds

- A highly experienced investing and operator network

- Long-term commitment through growth, expansion, and public markets

For early-stage founders, Peak XV runs Surge, their flagship accelerator program. Surge provides $1.5M+ in capital, hands-on operational support, and access to a powerful global founder network.

Is Peak XV Partners right for your startup?

Peak XV is best suited for startups with strong traction, large market opportunities, and ambitious scale potential. They are an excellent fit for founders raising Series A or later and for exceptional early-stage teams applying through the Surge program.

They are selective, but when they invest, they are known to stay the course for the long term.

Nexus Venture Partners

Nexus Venture Partners is a high-conviction venture capital firm with a strong presence in India and the United States (Bay Area). They are best known for backing technically strong, product-first founders who deeply understand what they are building. Nexus has built a reputation for working closely with engineering-led teams and supporting companies over the long term.

Where and how they invest

Nexus primarily invests at the seed and Series A stages, with cheque sizes typically ranging from $100,000 to $10 million (approximately ₹83 lakhs to ₹83 crores), depending on the stage and conviction.

Their core focus areas include SaaS, enterprise software, fintech, AI, and deep technical innovations. Nexus follows a high-conviction approach and stays actively engaged throughout the company lifecycle.

In December 2025, Nexus closed its eighth fund at $700 million, bringing total assets under management to approximately $3.2 billion, reflecting the firm’s scale and long-term capital strength.

Startups they’ve backed

Nexus has backed several category-defining companies across stages. Their portfolio includes Delhivery (publicly listed), Zomato (publicly listed), Postman, Zepto, Rapido, and Turtlemint, along with many B2B SaaS and enterprise software companies that have raised strong follow-on rounds globally.

Why founders like working with them

Nexus is especially valued by technical and product-driven founders. Founders choose Nexus for:

- Deep understanding of SaaS, enterprise, and AI-led businesses

- Strong alignment with engineering-led founding teams

- Strategic introductions to customers, partners, and global investors

- Cross-border support for Indian startups expanding to the US and other global markets

- Active, hands-on engagement from early stage through scale

Is Nexus Venture Partners right for your startup?

Nexus is a strong fit if you are a technically strong founder building a B2B SaaS, enterprise, fintech, or AI-driven startup with early product-market validation. They are particularly relevant for founders with global ambitions who want an investor capable of supporting growth across India and international markets.

Blume Ventures

Blume Ventures is one of India’s most respected zero-to-one stage venture capital firms. They are widely regarded as the most founder-friendly investor for companies navigating the messy early days of building. Blume is known for backing founders early, staying calm through pivots, and helping startups grow into category leaders.

Where and how they invest

Blume primarily invests at the seed and early Series A stages, with typical initial cheque sizes now ranging from $500,000 to $3 million (approximately ₹4.2 crores to ₹25 crores).

They are currently investing out of their $290 million Fund IV and have also launched specialised vehicles like the Blume Founders Fund for smaller, pre-seed bets.

In 2026, Blume’s focus areas include:

- Climate tech and sustainability

- Deeptech including EVs and robotics

- Indus Valley startups building for the Indian consumer

- SaaS and fintech, where they continue to stay active

Startups they’ve backed

Blume’s portfolio includes some of India’s strongest category leaders such as Unacademy, Slice, Spinny, GreyOrange, Carbon Clean, and Purplle.

They have a proven track record of backing companies early and helping them scale into large, institutionally backed businesses.

Why founders like working with them

Blume’s biggest strength is how they show up for founders when things are unclear. Founders value Blume for:

- A deeply founder-first mindset, especially at the zero-to-one stage

- Strong support during pivots and early struggles

- Access to the Blume Beacon platform, which helps with hiring, marketing, and ecosystem access

- Excellent follow-on support, helping startups raise Series A and B from global funds like Accel and Peak XV

They are known for being steady, honest, and highly supportive partners.

Is Blume Ventures right for your startup?

Blume is an excellent fit if you are an early-stage founder building in climate tech, deeptech, SaaS, fintech, or for the Indian consumer market. They are especially valuable if you want an investor who stays hands-on through uncertainty and actively helps you prepare for larger institutional rounds.

Prime Venture Partners (formerly AngelPrime)

Prime Venture Partners is one of India’s most respected early institutional venture capital firms. The firm was originally founded in 2012 as AngelPrime and rebranded to Prime Venture Partners in 2015.

Prime is known for its high-conviction, high-support philosophy, often being the first institutional investor in a startup. The firm is led by Shripati Acharya, Amit Somani, and Sanjay Swamy, with Brij Bhushan joining as a partner in 2024/2026.

What truly differentiates Prime is that all partners come from strong operating and entrepreneurial backgrounds, not just investing roles.

Where and how they invest

As of 2026, Prime focuses primarily on Pre-Series A and early Series A investments.

Their typical initial cheque sizes range from $1 million to $4 million, with a median of around $3.5 million (approximately ₹29 crores).

In March 2025, Prime announced its fifth fund of $100 million, with a strong focus on:

- Fintech

- B2B SaaS

- HealthTech

- AI-based services and platforms

They are known for building conviction early and continuing to support founders as companies scale.

Startups they’ve backed

Prime’s portfolio includes several iconic early-stage successes and strong exits, such as MyGate, Dozee, Niyo, Quizizz, and Ezetap (acquired by Razorpay).

Their investments reflect a clear preference for product-led, technology-driven businesses with strong fundamentals.

Why founders like working with them

Prime is widely respected for how hands-on and founder-aligned they are. Founders value Prime for:

- Deep operating experience across product, GTM, and scaling

- Strong support during the Pre-Series A to Series A transition

- High conviction investing with meaningful ownership

- Long-term partnership mindset rather than short-term outcomes

They are particularly effective at helping startups refine product-market fit and early go-to-market strategy.

Is Prime Venture Partners right for your startup?

Prime is an excellent fit if you are a serious founder building in fintech, B2B SaaS, healthtech, or AI, and are preparing for a Pre-Series A or early Series A round. They are especially valuable for founders who want their first institutional investor to be deeply involved and committed.

Chiratae Ventures (formerly IDG Ventures India)

Chiratae Ventures is one of India’s most established and consistent homegrown venture capital firms, active since 2006. The firm rebranded from IDG Ventures India in October 2018 and has since continued to scale its presence as a long-term institutional investor.

As of late 2025, Chiratae manages over $1.3 billion in assets under management across seven funds, making it one of the largest early-to-growth stage VC platforms in the country. They are widely respected for disciplined investing and strong capital return outcomes.

Where and how they invest

Chiratae is deeply active across Seed to Series B, while also operating a dedicated Growth Fund for Series C and beyond.

They are currently deploying capital from their fifth early-stage fund, which completed its second close at $150 million in September 2025, with a target corpus of up to $500 million.

In 2025, their sector focus spans:

- Fintech, consumer tech, enterprise software, and healthcare

- DeepTech and AI

- ClimateTech and SpaceTech

- DefenseTech and Quantum technologies

This expanded mandate reflects Chiratae’s increasing appetite for frontier and innovation-led businesses.

Startups they’ve backed

Chiratae has one of the strongest portfolios among Indian VCs. Their historical investments include Flipkart, FirstCry, PolicyBazaar, Lenskart, and Cult.fit.

They are also highly regarded for their exit track record, with 56 exits and 5 IPOs to date, including the FirstCry IPO in 2024.

Why founders like working with them

Founders value Chiratae for their balance of scale and stability. Key reasons include:

- Long-term, patient capital with deep institutional backing

- Strong follow-on support across multiple funding rounds

- Experience helping companies scale in India and internationally

- Proven ability to support startups through acquisitions and public listings

For early-stage founders, Chiratae runs Chiratae Sonic, a specialised seed-stage program designed for speed and support. Sonic offers fast investment decisions, often within 48 hours, along with access to mentorship, ecosystem support, and partner credits.

Is Chiratae Ventures right for your startup?

Chiratae is a strong fit if you are raising Seed, Series A, or Series B, and are building in fintech, consumer tech, enterprise, healthcare, or frontier technology areas. They are especially valuable for founders looking for an investor that can support growth from early stages all the way to IPO.

India Quotient

India Quotient is one of India’s most influential seed-stage venture capital firms, best known for backing India-first (Bharat-focused) startups. Their core thesis is simple: the biggest opportunities in India come from solving local, real-world problems, not copying Western business models.

While they actively back founders from tier-2 and tier-3 cities, India Quotient is also deeply embedded in the Bangalore startup ecosystem, especially at the earliest stages.

Where and how they invest

India Quotient focuses strictly on seed and Series A investments. As of 2025, their typical cheque sizes range from $500,000 to $2 million (approximately ₹4 crores to ₹17 crores).

They are currently deploying capital from their fourth main fund ($115 million). In addition, they launched a specialised Small Ticket opportunity fund in 2025 to continue supporting breakout portfolio companies in later rounds.

Their active focus areas include:

- Fintech and India-first SaaS

- Consumer tech and D2C brands

- Social commerce and creator economy platforms

- Startups built specifically for the Indian market

Startups they’ve backed

India Quotient’s portfolio includes some of India’s most recognisable consumer and fintech success stories, such as ShareChat (Moj), Lendingkart, Sugar Cosmetics, Giva, and FabHotels.

They are particularly known for spotting winners early and staying involved as these companies scale.

Why founders like working with them

India Quotient has one of the most founder-friendly reputations in the ecosystem. Founders value them for:

- Very early conviction, even when products are unpolished or pre-revenue

- Fast, decisive investment processes

- Direct, no-frills communication

- Strong hands-on support at the seed stage

- Continued backing through follow-on investments for top performers

They are often the first institutional cheque on a founder’s cap table.

Is India Quotient right for your startup?

India Quotient is an excellent fit if you are an early-stage founder building an India-first business, especially in fintech, consumer tech, social commerce, or the creator economy. They are particularly supportive of first-time founders and teams that may not fit the typical “VC-backed” stereotype but show strong insight into Indian users.

Angel investors vs. venture capital firms in Bangalore

This is where most founders get confused.

You have built something promising. You need capital. But the big question is:

Should you approach angel investors or VC firms in Bangalore?

Let’s break it down clearly.

Check size

Angel investors typically invest between ₹10 lakhs to ₹50 lakhs. In some cases, well-known angels may invest more.

Venture capital firms usually invest ₹50 lakhs to ₹5+ crores, depending on the stage, traction, and conviction.

If you need a smaller cheque to get moving, angels are usually the better starting point.

Involvement level

Angels are generally lighter-touch investors. They offer advice, mentorship, and introductions when needed but are rarely involved in day-to-day decisions.

VC firms are much more hands-on. This often includes board seats, regular check-ins, strategic input, and active involvement in hiring, fundraising, and growth planning.

Timeline to close a round

Angels move fast. Decisions can happen in days or a few weeks.

VC firms take longer, typically 4 to 8 weeks, due to deeper diligence and internal processes.

However, once a VC commits, they usually stay involved for the long term.

Follow-on funding

Angel investors rarely participate meaningfully in follow-on rounds.

VC firms actively support and invest in follow-on rounds for startups that perform well.

This matters a lot if you plan to scale aggressively.

When to approach angel investors

Angels make sense if:

- You are very early-stage (idea or just launched)

- You need credibility and mentorship more than large capital

- You want flexible terms and quick decisions

When to approach VC firms in Bangalore

VCs are a better fit if:

- You have traction (users, revenue, growth metrics)

- You are raising ₹50 lakhs or more

- You want strategic support, not just money

- You plan to scale fast and raise multiple rounds

Pro tip for founders

Many successful founders do both.

They raise a small angel round (₹20–50 lakhs), hit early milestones, and then approach venture capital firms in Bangalore for a proper seed or Series A round with stronger leverage.

What venture capital firms in Bangalore actually look for in startups

Let’s flip the perspective for a moment.

You are about to approach venture capital firms in Bangalore. You might be wondering:

Will they like my startup? Will this be enough to get funded?

Instead of theory or hype, the points below are based on patterns that show up repeatedly in VC conversations, pitch feedback, and funding decisions. While every investor is different, these are the factors that consistently influence how startups are evaluated.

So let me share what actually matters to them.

A market big enough to justify venture scale

VCs look for markets that are large and expandable.

In simple terms, the problem you are solving should have the potential to become a ₹1,000 crore+ opportunity over time. Venture capital firms are not built for small, lifestyle, or capped businesses.

The only exception is deep tech, where niche markets can still scale massively over time.

If the upside is limited, even a profitable business may not be venture-backable.

Traction that proves real demand (even if it’s early)

Traction is often misunderstood.

It does not mean you need ₹1 crore in revenue. Traction simply means: people want what you are building.

This could look like:

- 1,000+ active users

- ₹10–20 lakhs in monthly revenue

- 100+ paying customers

- A waitlist of 5,000+ users

Traction is proof that the market exists and your solution works.

A founding team investors can bet on

VCs invest in founders more than ideas.

They look for:

- Relevant experience (startup, product, or industry)

- Domain knowledge in the problem you are solving

- Complementary skills within the founding team

- Coachability and ability to adapt

A simple truth in venture capital:

An average idea with an exceptional team beats an exceptional idea with an average team.

Clear scalability and long-term growth potential

VCs ask hard questions:

- Can this become a ₹1,000 crore revenue business?

- Can it expand across geographies or customer segments?

- Can it build strong, defensible advantages over time?

If growth has a hard ceiling, VCs usually pass.

Even a profitable ₹10 crore business may not excite them if scale is limited.

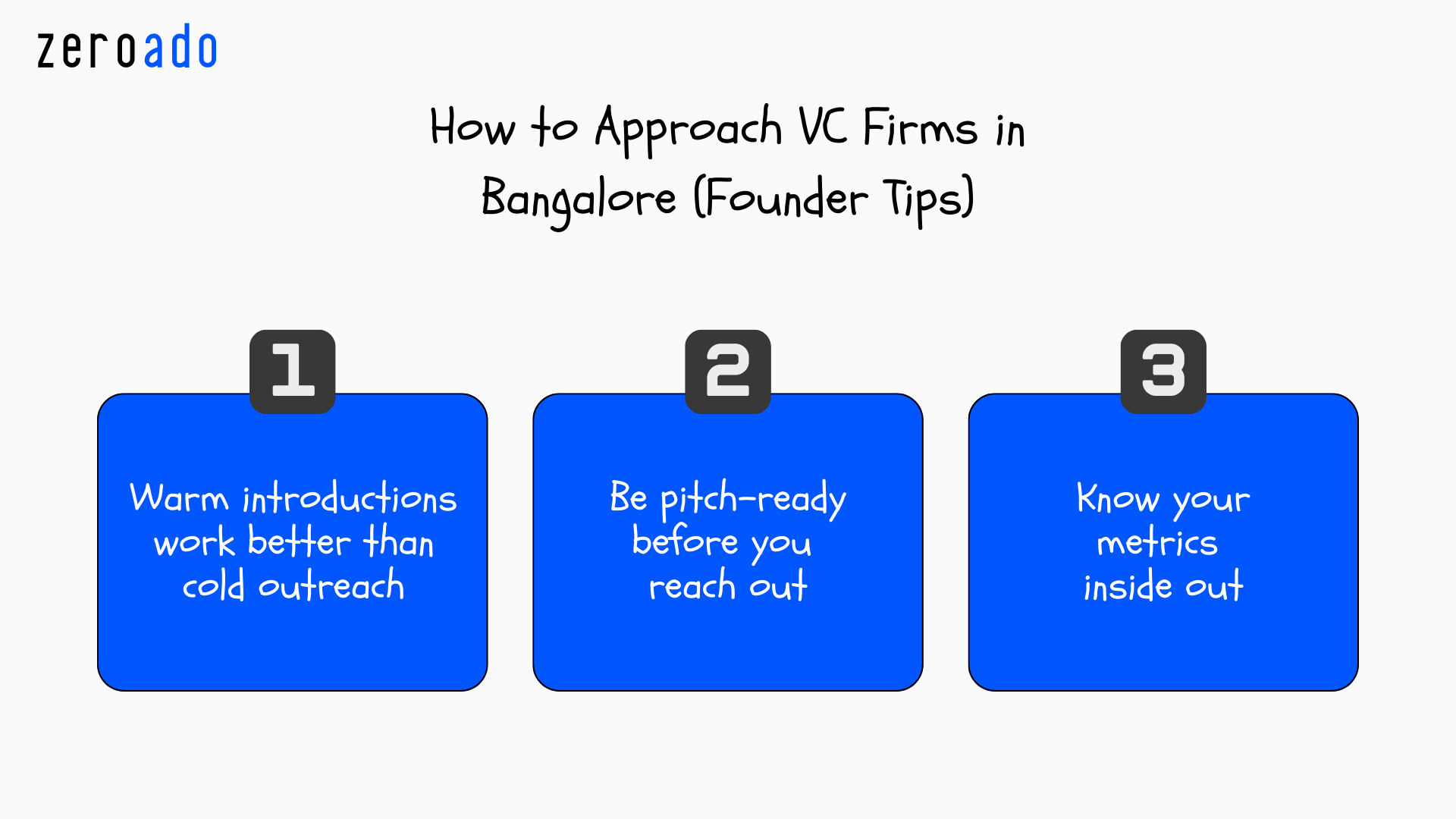

How to approach VC firms in Bangalore (founder tips)

Once you know which VC firms you want to approach, execution matters.

Warm introductions work better than cold outreach

Warm intros always outperform cold emails.

- Cold emails: 5–10% response rate

- Warm intros: 50%+ chance of a meeting

Ways to get warm intros:

- Ask founders in your network

- Reach out to mentors or advisors

- Check shared LinkedIn connections

- Attend VC-hosted events or startup communities

Be pitch-ready before you reach out

Before approaching any VC, make sure:

- Your pitch deck is 15–20 slides, not 50

- You can explain your startup clearly in 2 minutes

- Your traction metrics are updated

- You know how much you are raising and why

Clarity builds confidence.

Know your metrics inside out

Have these numbers ready and understood deeply:

- MAU or ARR

- Customer Acquisition Cost (CAC)

- Month-over-month or quarter-over-quarter growth

- Monthly burn rate

- Cash runway

Do not guess. Do not approximate.

Know why these numbers look the way they do.

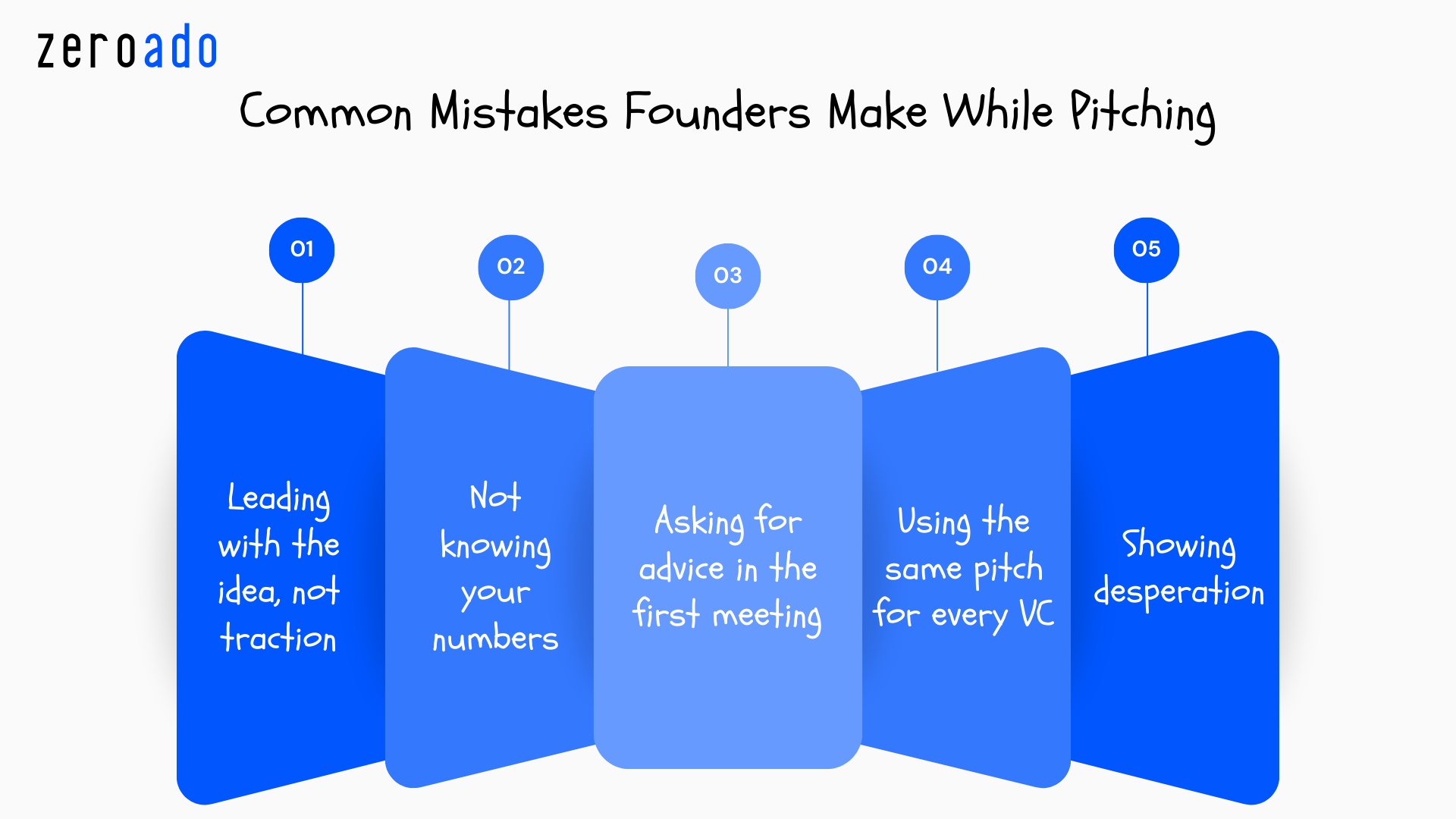

Common mistakes founders make (and how to avoid them)

Mistake 1: Leading with the idea, not traction

You spend 10 minutes explaining your idea. You mention traction in 30 seconds. Flip it. Lead with traction. Then explain the idea.

Mistake 2: Not knowing your numbers

Investor asks: “What’s your monthly burn?” You say: “Umm, I think around 15 lakhs?” That kills the deal. Know your cold numbers.

Mistake 3: Asking for advice in the first meeting

The first meeting is for them to assess your startup. Not for you to use them as a free advisor. Ask for advice after they commit.

Mistake 4: Using the same pitch for every VC

Different VCs focus on different things. 3one4 cares about founder obsession. Accel cares about scalability. Prime cares about execution. Tailor your pitch.

Mistake 5: Showing desperation

You need money. But don’t show it. Show confidence. Show that you’re willing to build with or without their capital. That makes investors want to back you.

Bangalore vs. other VC hubs in India

Let’s be honest.

Bangalore is still India’s startup capital.

Bangalore vs. Mumbai

Mumbai is India’s financial hub, but Bangalore dominates startups.

Bangalore has:

- More VC firms

- Stronger founder networks

- Better accelerator and mentor ecosystems

Mumbai shines in fintech and real estate tech, but Bangalore wins on diversity.

Bangalore vs. Delhi NCR

Delhi has a growing startup scene (especially in B2B SaaS). But Bangalore has more capital, more successful exits, and stronger founder networks.

Why Bangalore continues to win

- Strong tech talent pool

- Mature startup infrastructure

- Active VC presence

- Deep founder-investor relationships

If you are building a tech startup in India, Bangalore remains the best place to raise venture capital.

So, where do you go from here with venture capital firms in Bangalore?

If there’s one thing to remember, it’s this:

You don’t need to approach every venture capital firm in Bangalore.

The strongest founders don’t spray pitches. They shortlist three to five firms that truly align with their sector, stage, and ambition. The right fit will always matter more than the biggest logo on your deck.

Before you reach out, pause and do an honest self-check. Many founders start these conversations while working out of coworking spaces in Bangalore, long before they move into their own offices or larger teams.

- Have you hit a meaningful milestone, whether that’s users, revenue, growth, or clear validation?

- Is your founding team aligned and execution-ready?

- Can you explain your market opportunity without overcomplicating it?

- Do you know exactly how much capital you need and what it will be used for?

If the answer is yes, you’re ready to have serious VC conversations.

If not, that’s completely fine.

The smartest founders don’t rush fundraising. They focus on building, hit one strong traction milestone, and then approach investors from a position of confidence, not desperation.

Bangalore’s VC ecosystem is deep, active, and competitive. Investors are constantly looking for the next breakout startup. With the right preparation, that startup could be yours.

One thing founders often underestimate before fundraising is signals beyond the pitch deck.

VCs notice how visible your startup is.

They notice whether your positioning makes sense.

They notice if your messaging, growth numbers, and website tell a clear, consistent story.

This is where focused execution starts to matter.

At ZeroAdo, we work with startups that are actively building and scaling. Our role is to help you strengthen those growth signals through SEO, performance marketing, conversion-focused websites, and automation systems that support real, sustainable growth. Not to judge readiness, but to help you build momentum that investors naturally respond to.

If you want to strengthen your growth engine, just book your free call and we can discuss things over there.

Author’s note:

VC landscapes change quickly. Fund sizes, sector focus, and partner priorities evolve. While this list reflects firms actively investing in 2026, always verify the latest investment thesis on the VC’s official website before reaching out.

Good luck with your fundraising. Build well.

Handpicked Articles for You

FAQs on venture capital firms in Bangalore

Bangalore has 50+ active venture capital firms, but only a smaller group consistently invests at the early stage (Seed and Series A). In practice, around 15–20 firms are highly active year after year.

In addition to these core firms, specialised early-stage programs have become an important entry point for founders in 2026. Programs such as Accel Atoms, Peak XV Surge, and Chiratae Sonic allow founders to engage with large VC platforms at a much earlier stage.

Most Bangalore-based VC firms invest from Seed to Series A. Larger firms like Peak XV and Accel also invest in Series B and later rounds, often continuing to support companies through multiple stages of growth.

In late 2026, many VC firms also operate dedicated funds or mandates focused on high-growth sectors such as AI, DeepTech, and Climate Tech, even at the early stage.

Yes, early-stage startups can approach VC firms directly, and this has become more common in recent years. Warm introductions still improve response rates, but many VCs are increasingly open to direct outreach, especially through structured programs and clear founder communication.

For pre-revenue startups, particularly in DeepTech or AI, VCs often look for additional validation such as:

– Strong technical founding teams

– Patent filings or defensible intellectual property

– Proven research or prior technical work

Pure idea-stage pitches without any form of validation remain difficult to fund.

Yes. Many Bangalore VC firms actively back first-time founders.

Firms like India Quotient, Blume Ventures, and 3one4 Capital have consistently supported founders early, even before everything looks polished. While domain expertise and execution matter, being a first-time founder is not a blocker if the insight and approach are strong.

Typically, the funding process takes 4 to 12 weeks from the first meeting to a term sheet.

– Early-stage and seed-focused firms may move faster, sometimes in 2–4 weeks

– Larger funds often take 8–12 weeks due to deeper diligence

Founders should always clarify timelines early to plan runway and outreach properly.

Yes. Most prominent Bangalore-based VC firms invest across India, and many also invest globally or across Southeast Asia.

While Bangalore is a major startup hub, location matters far less than:

– Market opportunity

– Founder quality

– Scalability of the business

Strong startups from anywhere can raise capital from Bangalore-based VCs.